When we think about building a strong CRM strategy, it’s really about the entire customer lifecycle. How you market to leads, how you acquire and onboard new customers, how you manage regulatory rules, and how you provide customer service.

With Salesforce, you can manage all of those aspects in one place by combining the power of nCino, which helps you originate and manage loan transactions, with Salesforce Financial Services Cloud and Tableau CRM’s powerful analytics.

I sat down with Steven Hatheway, Partner Account Executive at Salesforce, and Matt Berthold, EVP and COO at Westfield Bank, to talk about the power of these three tools working together as one platform. You can watch the full session here, or read on to learn more. Let’s dive in:

How nCino works together with Salesforce Financial Services Cloud

The best banking and lending institutions take a customer-centric approach to their business.

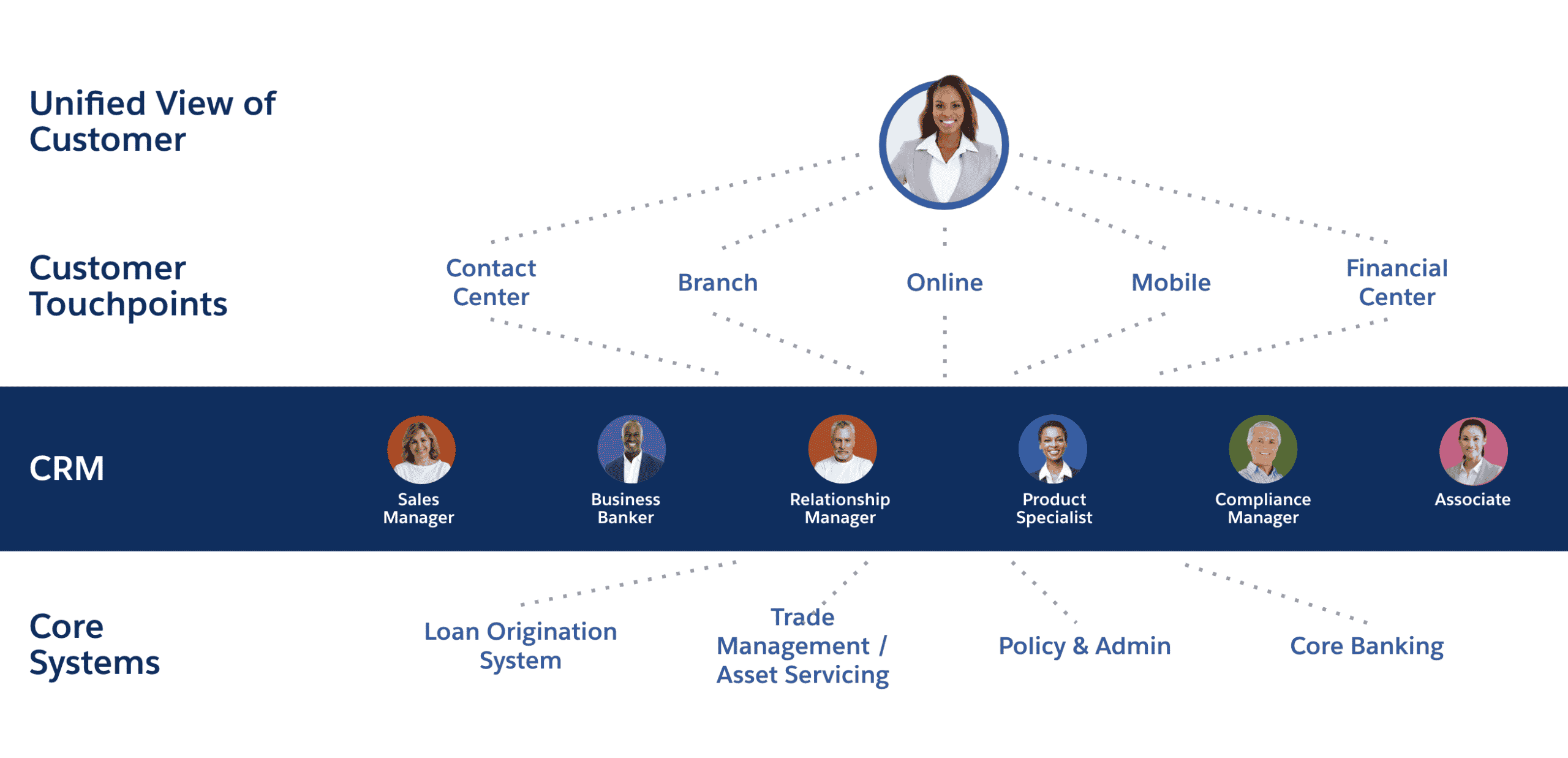

Doing this unifies your data and helps you build a robust view of the customer. Sometimes this data resides in Salesforce, while sometimes it’s in a core system or a partner system. To be able to use that data, you need to bring it all together in one place, surface up relevant insights for your team, and identify and support customer needs throughout the entire lifecycle to be able to deliver on the expected customer experience.

nCino enhances the data model you’ve already built of your customer behavior. It fuels your organization’s vision with an employee and customer workflow that generates key data points and builds connections to the rest of your sales, marketing, and transactional data within Salesforce. The more data your team can access, the more productive and focused they can be.

Whether you’re trying to prioritize leads and outreach opportunities for relationship managers, triage incoming calls for contact center teams, or develop new business opportunities, delivering personalized customer engagements at the right time is going to be the key differentiator. – Steven Hatheway, Partner Account Executive at Salesforce

This is where financial services intelligence comes into play. How can you make the right information universally available, tailored to the right role, and push those insights to your team exactly when they need it?

The answer is in the right tools. Think about the way your organization likely had to adapt to deal with the Paycheck Protection Program (PPP) in 2020. You’re bringing in new customers, understanding how to leverage those relationships, and answering their urgent questions — all during a global pandemic.

Providing those customers a great experience is what’s going to bring them back to your bank when they’re ready to take the next step in their businesses, or start something new.

How Westfield Bank is innovating with nCino + FSC

Westfield Bank recently celebrated their 20th year in business. The northeastern Ohio bank focuses on commercially-driven community-based lending, and as they continue to grow, they realized they needed to scale their technology platforms — so they came to Silverline.

A dynamic and scalable loan origination solution

Westfield Bank implemented nCino first, because they needed a best-in-class commercial loan origination platform.

As they implemented nCino, the team knew they needed to think more holistically about their entire customer experience, since loan origination was only one piece of the puzzle.

It was really important to confirm we had the right steps in the process, get those basics locked down, and really map all of that out. We had to revisit our sales process and sales cycle to create a more consistent approach across the team. We’re focused on a digital transformation journey that enables seamless interactions between clients and employees across the business, and nCino was just the first step. – Matt Berthold, EVP and COO at Westfield Bank

Investing in digital transformation — and looking at the bigger picture — enhances the client experience and provides more features and capabilities that increase productivity and profitability for the entire team.

A little over a year after starting nCino, they were ready for something more.

Building a full client experience workflow

The more they dug into their customer experience, the more they realized the power of a custom-built platform meant to scale with them. Financial Services Cloud was built with banks like theirs in mind, making it easy to manage three key elements of their process:

- Understanding the client relationship, including tracking multiple accounts and businesses for each client in one place

- Understanding their performance, racking financial accounts for loan deposits, investments, and insurance policies

- Understanding their process more clearly, tracking leads and referrals to build a more robust sales cycle

We chose to partner with Silverline to implement Financial Services Cloud because of their deep expertise in the banking industry, and we knew that they’d help us manage the entire sales cycle from Salesforce to nCino and back again. We have a lot of disparate systems, and investing in FSC gave us a better way to centralize our client conversations, enhance the client experience, and make it easier for our team to get their jobs done. – Matt Berthold, EVP and COO at Westfield Bank

That 360-degree-view of their customers makes it easier than ever to grow and scale their business while delivering top-notch experiences.

Intelligently managing sales pipeline

Finally, with Tableau CRM, Westfield Bank can more effectively manage sales pipeline by stage, including forecasting revenue, closed/won business, and loan reporting.

If we have concerns, we can really drill down into the problem to find out what’s wrong and make adjustments. We have access to so much more data than we did before, and it’s so helpful as we look to manage our business. We have a much more complete picture. – Matt Berthold, EVP and COO at Westfield Bank

Instead of digging through ten different databases for that information, they can see it all in one place. Because they know cycle time, conversion rates, and their sales leaderboard, they can make adjustments on the fly.

Silverline can help you transform your banking and lending operations

Technology is only as good as the business processes they’re powering. If you’re still working with an inefficient process with too many moving parts, no amount of technology will solve that problem.

That’s why Silverline deep-dives into every engagement so we can make sure we’re deploying Salesforce technology in a way that works to make your business better. We focus initially on getting as much data as possible into your hands so you can understand the full picture of your business — and from there, work to optimize your processes and build systems around them.

The combination of nCino, Financial Services Cloud, and Tableau CRM means the possibilities are endless. As we look ahead to Salesforce’s roadmap, it’s a truly exciting time to invest in digital transformation, bringing your banking operations into the future. Catch the webinar replay to hear more from Steve and Matt, plus a demo of what it all looks like in real-time. Watch now.