Are you ready for 2021? Salesforce’s winter release comes out starting January 8. I recently had the privilege of sitting down with Tom Everard, Principal Solution Engineer at Salesforce, during my Salesforce for Insurance Trailblazer Community meeting. (That’s just one of the perks of being a Trailblazer Community leader and Salesforce MVP!) Tom distilled the 284 Winter ‘21 release slides into the most important updates for the insurance community. It was a fantastic, consumable debrief of what to look for. (Who wants to read 500+pages of release notes?!)

Check out the recording for a quick listen, or read on below for our favorite insurance-friendly features from the Salesforce Winter ‘21 release notes.

Tom’s favorite pick: Dynamic Forms and Dynamic Actions

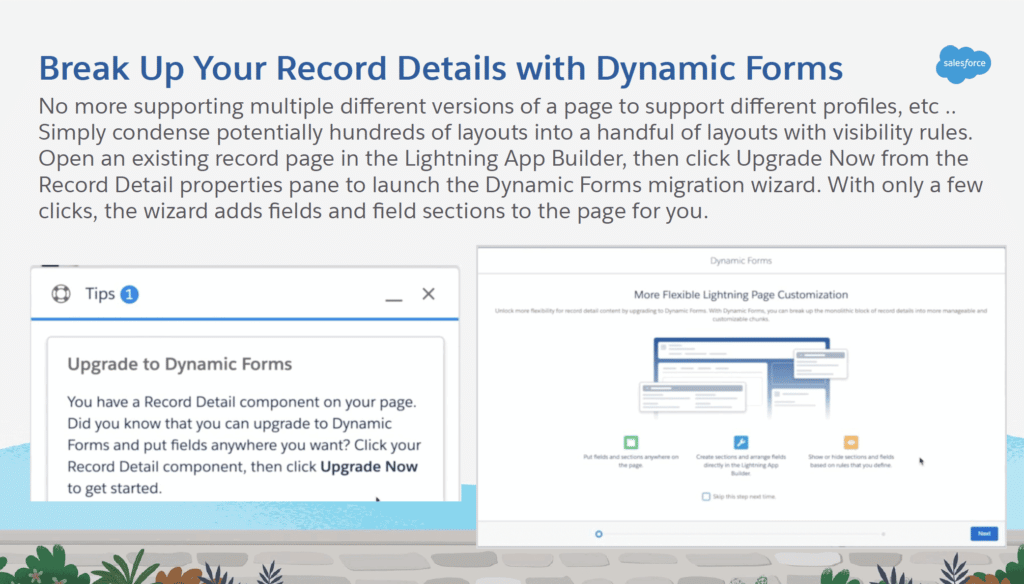

Dynamic Forms displays the right information at the right time for the right person on a page layout, allowing for a more user-centric intuitive experience. The benefits include:

- End-user increased productivity through rearranging fields

- Visibility rules that keep pages cleaner and more relevant. The visibility rules can be set at a granular, field level to expose only the right information to under the right conditions (based on persona, device, and permission, for example).

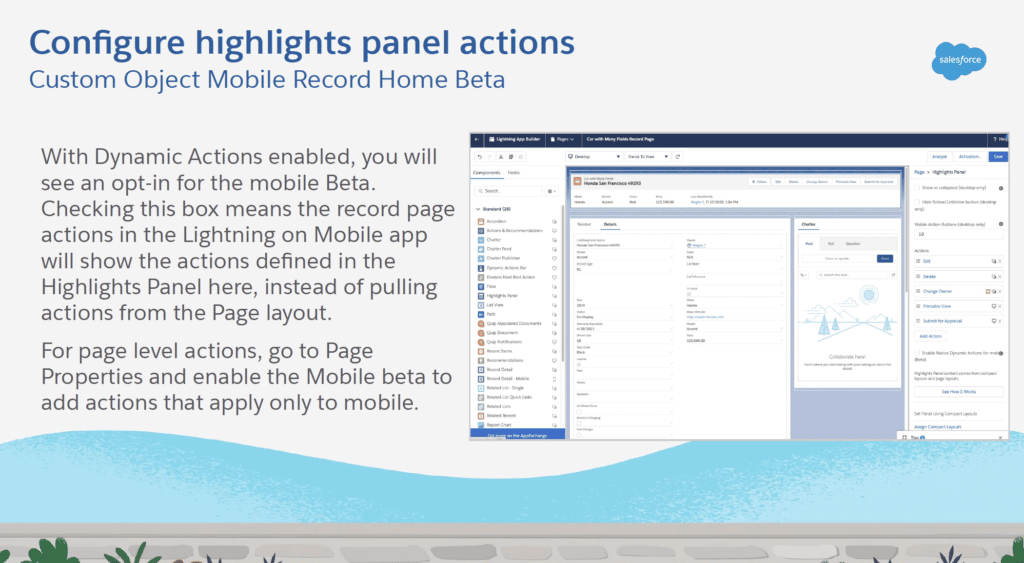

Dynamic Actions, available on Accounts, Contacts, Leads, Opportunities, Cases, and custom objects, allows admins to easily configure Profile-specific actions and Context-based actions right from within the Lightning page. This improves the user experience with a personalized experience based on real-time data if different actions are needed based on the stage or step of a process.

Added bonus: time-savings for Admins. They now have the ability of condensing potentially hundreds of layouts in their org into a handful of layouts with visibility rules. Double bonus: a migration wizard guides the process of updates. Check out the details in the Winter ’21 insurance release notes.

Danielle’s favorite pick: Account Relationship Support for Insurance

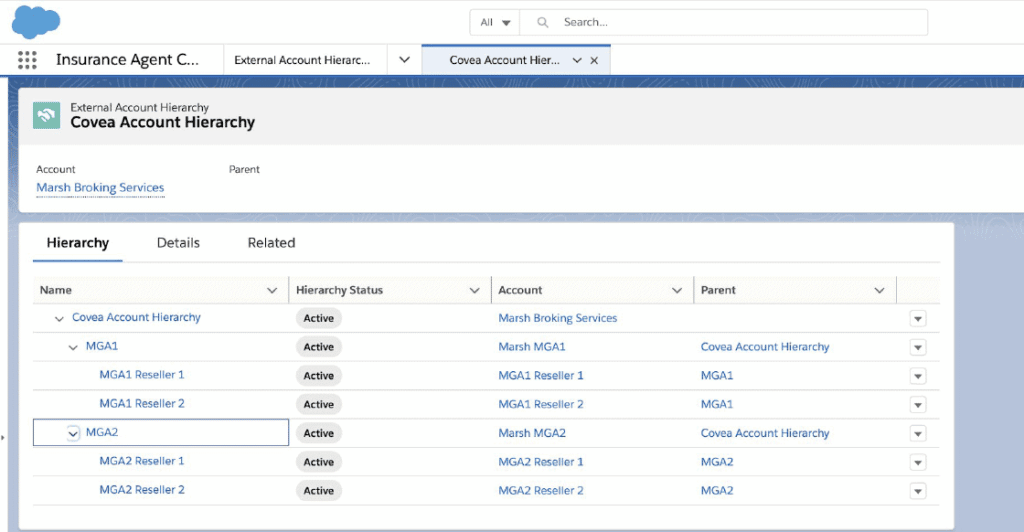

Why do relationships matter? That’s what CRM is all about! The relationships between entities has been sorely missed until now in the Insurance space. The ability to model and manage a complex hierarchy for both the partner and the carrier sides for all Insurance-specific objects (claim, customer property, business milestone, insurance policy, and person life event records) is something clients ask for in every project I do.

Take a brokerage service organization with multiple agencies. The Account Relationships feature rolls up to a single distribution channel without creating multiple public groups or handling complex data sharing rules. A combination of External Account Hierarchy and Account Relationships allows for agency modelling, giving a view of the book of business of the entire distribution chain.

This is HUGE for the insurance world! I’ve been hoping for something like this for years – roll-up security has historically been a complex problem. Visibility on the book of business is crucial to measure business health and effectively manage the producers.

Additional highlights

Policy Component enhancements

Household view now supports Policy Component. This gives agents a consolidated view of all household policies. Easily identify new opportunities and devise cross-sell and upsell plans, showcase the KPIs for policies owned by the Household, and group policies based on the Policy type with this update. You can also highlight policy owners and participants.

There are also a couple policy component enhancements, including:

- Tailor policy info to your agents’ needs by filtering policies based on their record types

- Add new policy records without leaving the page with a “New Policy” button.

Compliant Data Sharing

Ensure client engagement and deal data containing material non-public information (MNPI) is shared in a compliant manner. Define rules for what client-related data can be shared with which team members based on the role they play in the context of a client engagement.

Watch the full Salesforce Industries: Financial Services Cloud Compliant Data Sharing coverage here.

For a list of all the Winter release features and enhancements, check out the release notes.

What now?

Have a question or thought? Drop me a line: [email protected].

I’d be happy to answer. If you have a topic you’d like me to discuss at an upcoming Salesforce for Insurance Trailblazer group session I’d be happy to cover it.