The challenge: An outdated, manual process for quoting

The entire mechanism for requesting a quote was outdated and had to be overhauled. Agency staff would submit paper/PDF applications via mail, upload, or email, an outdated process with no visibility into the quoting process after agency staff requested a quote. If there was missing information on an application, an underwriter would need to follow up to track it down. On average, it took six days to issue a quote, a window of time that was unacceptable in an increasingly fast-paced world.

SIF sought to provide:

- A streamlined method for agent staff to request a quote with faster turnaround times

- Instant quotes for small risks

- Visibility into the quote process/timelines

A rapid advancement in technology, a modern platform, and integration support were required. The Salesforce Industries solution was selected to extend back-office functionality and add application support for SIF’s agency partners.

While SIF’s goal was to improve ease of doing business for its agency partners, a more automated process would also improve the efficiency of their underwriting team, allowing them to focus on more complex, higher value business.

Building a first-of-its-kind solution for workers’ compensation insurance

SIF partnered with Silverline for implementation support. Through the partnership, SIF created a solution that was new within the Salesforce Industries ecosystem: a broker-facing portal with automated quoting and underwriting for workers’ compensation insurance.

Silverline and SIF teams began with joint design sessions. SIF’s team contributed greatly to the design of the final product. Their team’s deep knowledge of business processes for the industry, workers’ compensation, and the way they do business in the Idaho market assured a solution that fit SIF’s needs. This design would ensure accuracy and completion of required data, important elements for implementation and expansion of instant quoting.

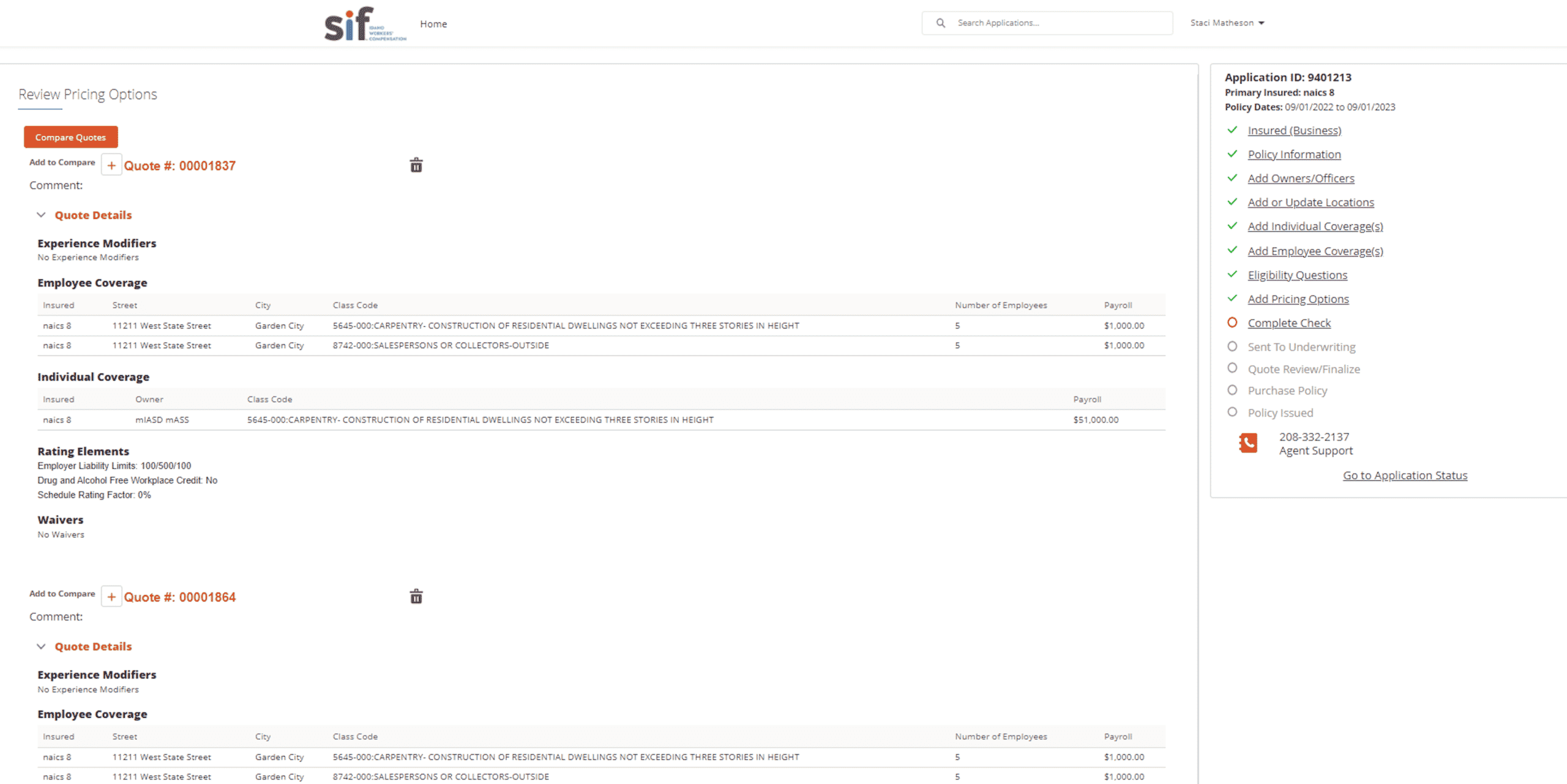

SIF’s setting among Idaho’s great outdoors brought about the concept of a “Touch Tree.” In the wilderness, it’s a place to come back to, a compass for direction.

Creating the touch-tree was a critical piece of the overall concept. It provided a much-needed visual representation to tell the user where they were in the process, and more importantly where they need to pick up on incomplete work, without having to wade through the application again. – Malcolm O’Brien, Senior Business Analyst, SIF

The “Touch Tree” became an application navigation module that breaks down each part of the application process. No matter where one moves around the application process, there is a “Touch Tree” to come back to and guide the user to the next step. The “Touch Tree” was created with OmniStudio components. It’s become useful in guiding users through the data collection process and creating documents for both the agency staff and underwriters.

No code was written for calculating the rates and creating the quote. Salesforce Industries’ quoting services were used to rate the product and create the quote via integration procedures. The solution includes a Salesforce Partner Community, which serves as a hub for the agent to create and manage their applications.

In the past, a substantial number of submissions were abandoned with form processing. Incomplete submissions, requests for additional information (without response), and extended time-to-quote duration were among the primary causes. Much of this is mitigated with SIF’s quoting portal: SIFQuote. The solution will also allow SIF to gather data on abandoned submissions to easily track those abandoned submissions and address the underlying reason to continue minimizing abandoned quote requests.

Decreasing quoting time with a digital portal

SIFQuote dramatically advances SIF’s digital presence in the market by replacing a traditional form-based submission process. SIF can provide instant quotes for a small but growing subset of new submissions. Since SIF writes a high volume of small business in the Idaho market, reducing friction on small business submissions eases the workload for SIF and its agency partner staff.

With automation of small business submissions and quoting, Underwriters can focus on more complex risk decisions. This results in better scalability and overall improved response times. The average quoting duration has gone from six days to under an hour, often providing a quote in minutes.

SIF’s partnership with Silverline provided the Salesforce and Salesforce Industries expertise that was critical to delivering the solution. Their guidance on the platform and technology to support creative solutions to SIF’s quote and issuance problems helped make SIFQuote a game-changer for Idaho agents. One of the core values at SIF is innovation; that’s defined as the promise to make workers’ compensation easier to understand and transact. SIFQuote delivered on that promise.