Let’s talk about the so-called TikTok Feta Effect. If you’re part of Gen Z or a millennial, you probably already know the phenomenon we’re referring to. For all of you that were born before 1981, let us explain.

Versions of a baked pasta recipe made with a big block of feta started to pop up on TikTok in early 2021, and the simple recipe that appealed to Gen Z immediately drove millions of views. As a result, Instacart started to notice that sales for block feta had skyrocketed 117%, and the cheese was now the top-trending search term on its website. The other recipe ingredients for cherry tomatoes and basil were not far behind.

Creators in the TikTok marketplace are major influencers on buyer behaviors and shopping habits, and 37% of users discover a product on the app and immediately want to buy it. According to the Hootsuite Digital 2022 Report, TikTok’s reach is highest for Gen Z users aged 18-24, reaching 25% of females and 17.9% of males, and those Gen-Zers are buying feta and lots of other products as well. It’s no surprise that feta cheese is part of the popular hashtag #TikTokMadeMeBuyIt, which amassed over 7.4 billion views in 2021.

Media organizations are all trying to achieve the desired TikTok Feta Effect but with an ad sales strategy that aligns with their specific brand and audiences. Many are challenged by the massive transformational change happening in media brought about by cookie deprecation and the shifting advertising models affecting audience targeting and engagement. But those media organizations that can find the right alignment will succeed in driving advertisers’ commerce, loyalty, and awareness.

Programmatic ad strategy takes a hit

The recent headline making the rounds in advertising circles is that Bloomberg Media will stop serving open-market third-party programmatic display ads on its website and mobile app beginning in the new year.

But why would a leading publisher decide to turn off one of its sources of advertising revenue? Because Bloomberg Media has its eye on the long-term possibilities.

Programmatic has a reputation for serving up low-quality ads without much control over if the ad creative or product will align with the media brand. By providing a better user experience built on quality advertising and content, Bloomberg Media hopes that over time the initial revenue drop from the loss of programmatic will be replaced with a higher-quality audience of readers. And this desirable audience equals more opportunities for the publisher to monetize its advertising.

Finding high-quality audiences among cookie deprecation

More publishers are expected to follow Bloomberg Media’s lead and drive more value from their premium advertising inventory by essentially closely guarding their platform and carefully deciding who they do and do not invite in. By controlling their audience, they are in tandem controlling how they are defining their brand – and that brand reputation matters when it comes to advertising strategy.

But unfortunately, programmatic is at the bottom of the list for being able to meet advertiser expectations of delivering a high-value audience, especially when considering the impact of a cookieless future, because programmatic relies heavily on third-party cookies.

Third-party cookies allow publishers to track and gather data around their users. They can then use this valuable data to sell specific audiences to advertisers. But the bad news is that Google will stop the use of third-party cookies in Chrome sometime in the foreseeable future, with an exact date still to be determined.

Publishers will lean more heavily on their first-party data without third-party cookies as part of their ad sales strategy. But the problem is that the industry is somewhat unprepared for the loss of third-party cookies.

The Interactive Advertising Bureau’s State of Data report surveyed industry leaders across brands, agencies, publishers, ad tech, and data companies. The report found that although over three-fourths (77%) of the industry claim to be prepared for the loss of cookies and identifiers (+15% YoY), most are not taking the necessary steps to adapt their data approaches and operations:

- 59% are not increasing their investment in first-party data

- More than two-thirds (69%) are not increasing use of AI

- Two-thirds (66%) are not adjusting their measurement strategies this year

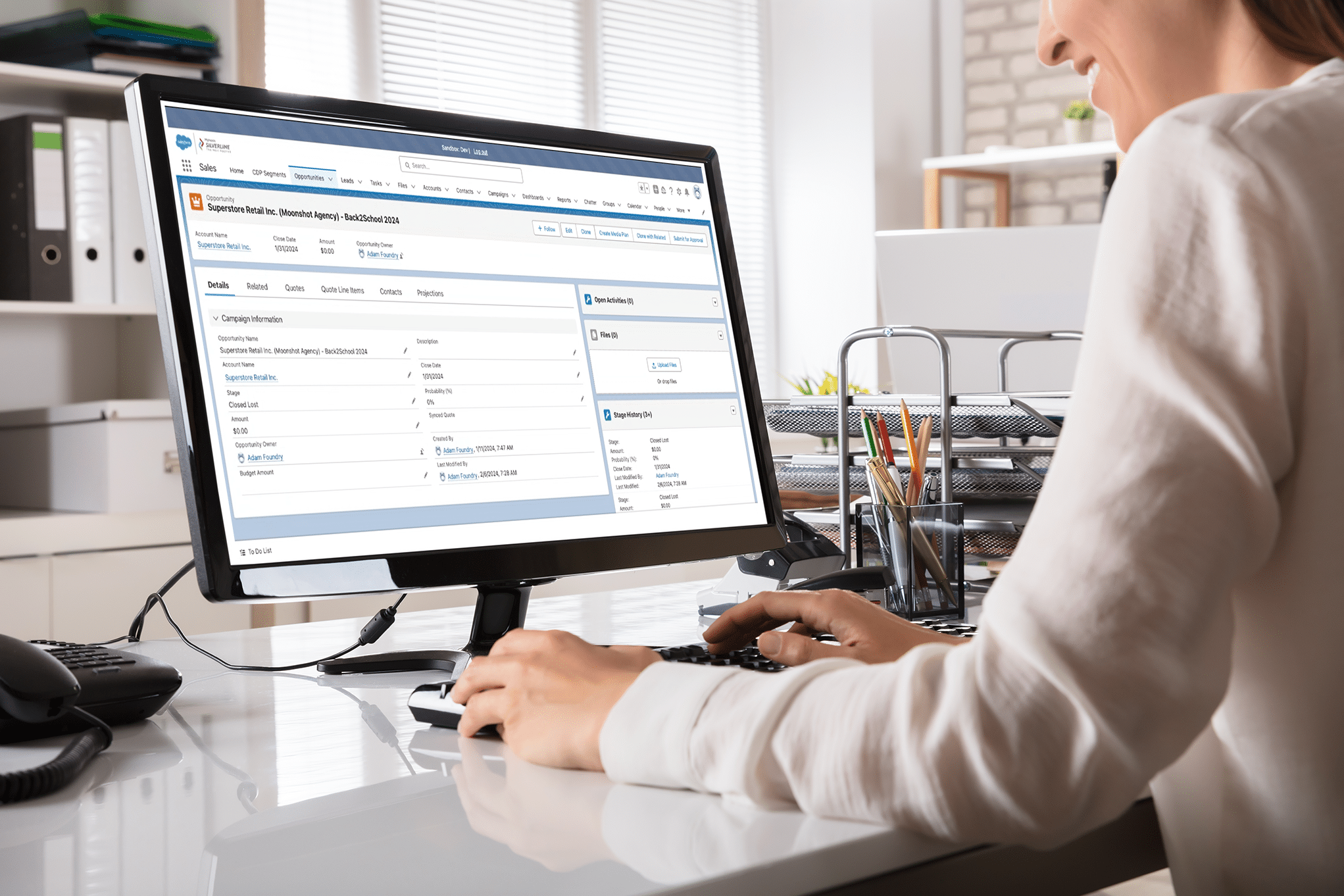

How Salesforce helps ad sales strategy

Publishers need to adapt their ad sales strategy to prepare for the loss of third-party cookies so they can continue to deliver the highly desirable audiences that advertisers want. And that means taking a hard look at their audience data strategy and ensuring they have the right Salesforce tools to support it.

Salesforce is developing and launching technologies that are allowing publishing companies to centralize and aggregate their first-party data. This data is paired with a publisher’s customer data platform (CDP) to create individual user profile views. The data is stitched together with other first-party data sources and used to build audience segments.

These segments can then be sold – with proper justification – to advertisers at a higher CPM because the data is being used to target the advertiser’s sought-after audiences. It’s like the TikTok Feta Effect, where if a publisher provides the right ad in the right environment to the right audience, then consumers will most likely engage with and purchase the feta or whatever product is being touted.

Salesforce Genie is a publisher’s strategic answer to delivering high-quality audiences. The tool builds upon Salesforce CDP and adds on a real-time integration layer. Salesforce Genie unifies siloed customer data into a single source of truth to create a complete customer profile. It aims to reconcile all the many identities one individual could have across a media organization, and the result is a single, clean record for each individual customer.

Silverline is your strategic ad sales partner

Ensure you have the right foundation in place for your ad sales strategy with Silverline. We can help your media organization deliver high-quality audiences to advertisers, drive higher premiums, and prepare for the future with first-party data. Silverline leverages insight acquired through thousands of engagements along with real-world expertise gained across the Media and Entertainment industry, including: broadcast, publishing, and agencies. Find out how we can help your organization.