Banks and credit unions are facing shifting customer preferences and realizing that experience matters. To be successful, banks and credit unions need to truly collaborate around the customer. True collaboration needs to be embraced to develop new engagement models that focus on human interaction with digital tools to solve problems and provide support for customers where and when needed. They need to be able to offer insightful interactions throughout the customer lifecycle by leveraging the data to reduce friction and drive seamless experiences.

Financial institutions need to evolve with their customers and deliver personalized experiences that meet their specific needs. This age of collaboration calls for a new engagement model that emphasizes the human touch and solving real problems. This model increasingly calls for marketing automation.

Why do you need marketing automation?

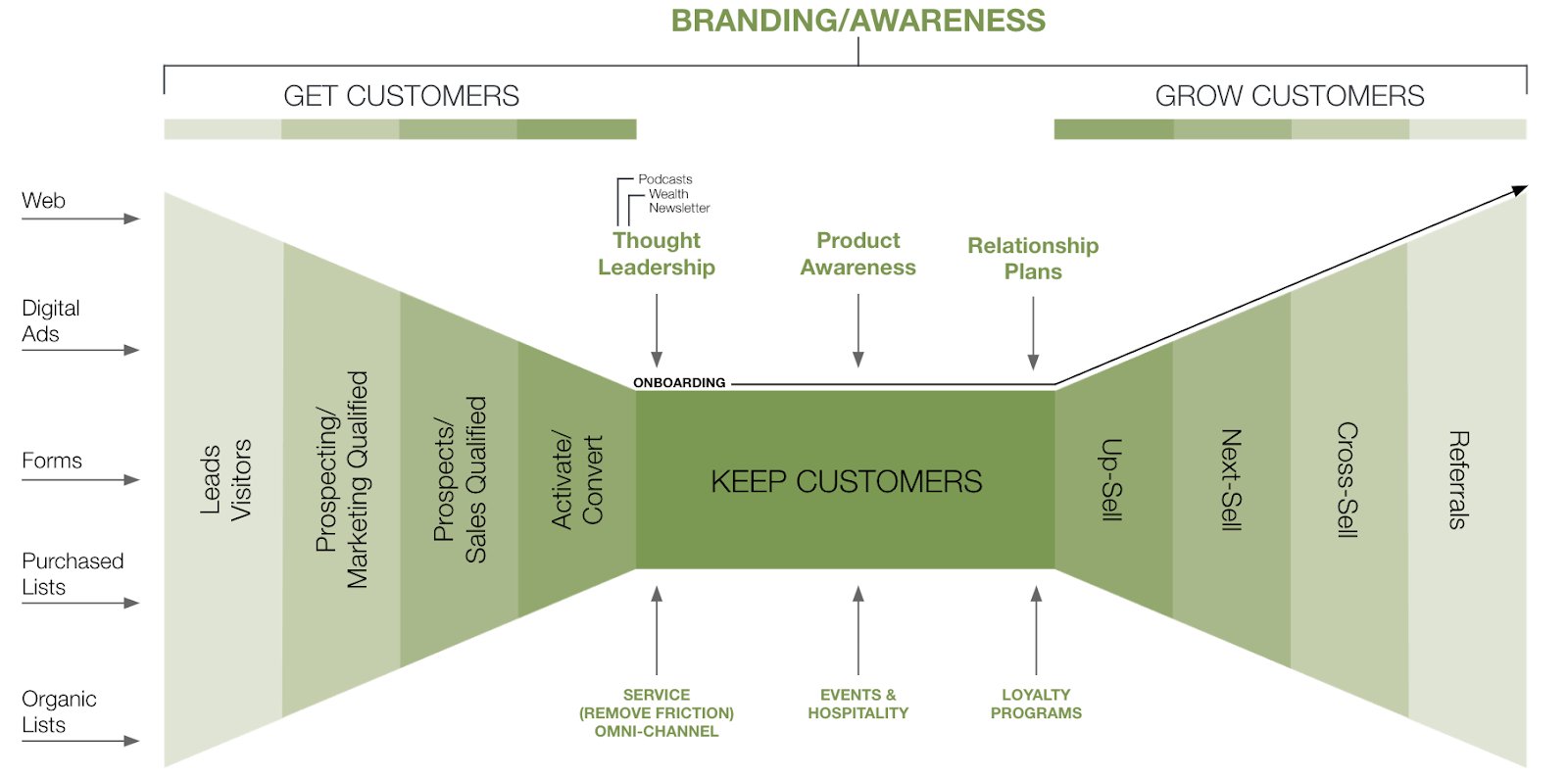

Marketing automation is a journey… literally. It is not an initiative you can jump into and achieve at once. It requires every organization to understand the customer journey across all unique experiences. Marketing automation connects multiple touchpoints and marketing channels, including social media, email marketing, content marketing, and the associate-to-client interactions.

Most financial institutions have numerous systems and teams sending messages to clients and prospects. By investing in a marketing automation platform you will be able to:

- Consolidate transactional and promotional messages

- Create brand consistency and personalization

- Control the volume and types of messages your customers receive

- Gain visibility into all digital and physical interactions taking place in the customer journey

- Integrate the journey across all channels and connect to CRM to optimize value

- Create meaningful segments

- Gain efficiency and create scale within the marketing team without adding headcount

- Manage and improve campaign ROI

Where should you start?

A successful marketing automation program starts with enterprise strategic alignment to measure program success and data. Most financial institutions can look to their core to find a unique customer ID to drive most experiences at the beginning of the journey. In addition to identifying your customer, it is also important to create messaging and persona segments. Segmentation will continue to grow and evolve over time, but at the beginning of this journey, I recommend starting with line of business segments:

- Commercial banking

- Business banking

- Small business

- Consumer

- Private banking

Once you know what your data looks like, I recommend mapping out a few foundational customer journeys:

- New customer onboarding

- New financial account activation

- Sales funnel campaigns (mortgage pre-qual)

- Web to lead

- Customer retention/engagement

- Maturing accounts

- NPS/CSAT

- Events and sponsorships

From there, you are ready to start activating your customer journeys. It is important to monitor results and test variables to drive optimal performance and establish core reports and dashboards for your team to review regularly.

What’s next in your journey?

Now that you have successfully started on your marketing automation journey, you need to maximize your investment and build your roadmap capabilities:

- Additional business units to allow multiple teams and brands to work within the platform

- Distributed marketing to empower associates who interact with customers daily to send approved content within Salesforce

- Social Studio to capture sentiment and engage customers across channels

- Ad Studio to retarget and build brand awareness through digital advertising driven from Salesforce and Marketing Cloud data

- Audience Studio to profile your customers, create lookalike audiences, and drive quality leads through a powerful data management platform

- Mobile Studio to personalize your mobile marketing with SMS messages, push notifications, and chat messaging

- CMS Integration to connect customer data with web activity to deliver insights and offers that are relevant

- Interaction Studio to visualize, track, and manage customer experiences with real-time interaction management — driving valuable engagement at the right moment, just the way your audience prefers

Start your marketing automation journey with Silverline

Your customers demand more. They want to be known and catered to where and when they most prefer. In an age of collaboration, marketing automation is what separates a run-of-the-mill experience from a deeply personal one. See what we have to offer banks and credit unions looking to make the shift to a customer- and member-centric experience.