Reading Time: 4 minutes

Customers of banking and lending enterprises are increasingly choosing products and services based on the quality of the experiences they have with them. These experiences are becoming more and more complex and spanning channels, technologies, and departments. As this complexity is introduced, the customer experience can often break down.

Enter UI/UX (user interface/user experience) design, which helps accelerate digital transformation while meeting the customer demand for seamless and personalized experiences. By keeping audiences’ needs and behaviors at the center of the design process, you’ll create long-lasting, positive business outcomes for your financial organization.

Why UI/UX design is important for banking

Let’s start with an extreme example of what can happen when UX takes a nosedive. In a nutshell, Citibank screwed up. In August 2020, the bank accidentally approved a $900 million payout to cosmetics and personal care company Revlon instead of the $7.8 million it meant to send.

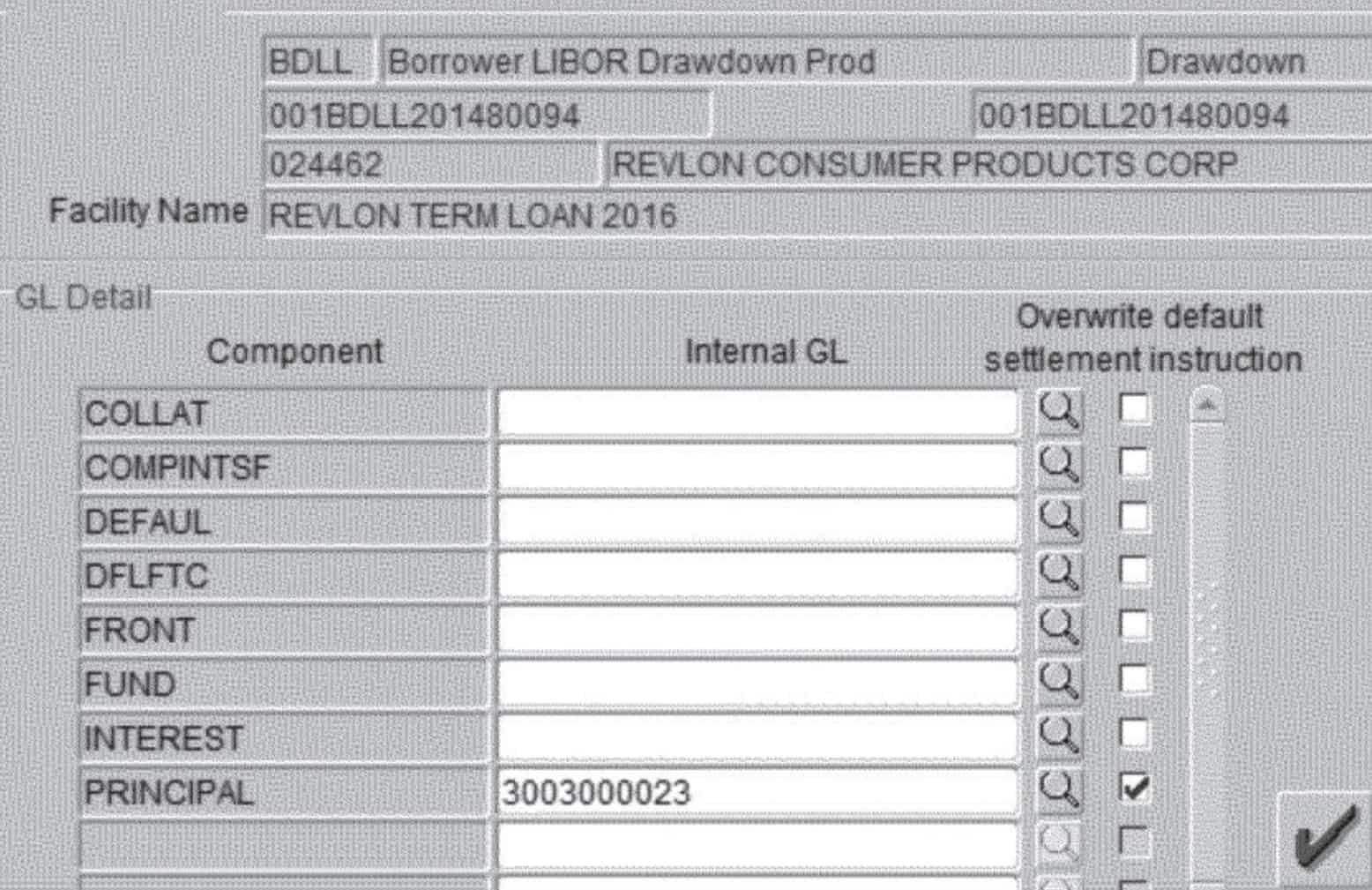

Citibank mistakenly wired the full loan amount (interest and principal) to the creditors. It included $7.8 million in interest and $894 million in principal for a total of roughly $900 million.

The culprit of this error? UX design. The transfer software required the users to check three boxes to overwrite the default settings of Front, Fund, and Principal. However, the users thought that only the Principal box needed to be checked.

The debacle ended up in court. Citibank recouped some of the money but still lost about $500 million from some lenders who refused to pay back the money.

Three people at Citibank checked and approved the specifics of the transfer before it was sent, but obviously, the design of the software failed its users. There was a lack of user knowledge of how the software worked and no error prevention built into the software.

A fundamental principle of UI design is to prevent a problem from occurring in the first place by either eliminating error-prone conditions or checking for them and presenting users with a confirmation option before they commit to the action. It is like when Microsoft Word’s pop-up box asks if you want to save your document before closing it. But losing a document is much less significant than losing half a billion dollars.

3 ways UI/UX design helps with better banking

So, how can banks and lenders best optimize their user experience so they don’t become the next Citibank situation?

The key is in taking a human-centered design approach to problem-solving. It starts with understanding the needs, goals, and wants of the users you are designing for. This ensures that you are solving the right problems for your customers and employees and aligning the goals of your users and business to make the most strategic and impactful technology decisions.

These are three scenarios we see with customer interactions at financial institutions and ways to improve them with enhanced UI/UX design.

1. Onboarding new customers

Just like when you welcome guests into your home, banks also need to lay out the welcome mat for their new customers. But often, this welcome isn’t warm and friendly because the first thing new customers face is massive amounts of paperwork to review, sign, and send – it becomes an obstacle course of challenges with no finish line in sight.

To save time and aggravation, banks should design an interface with a new customer checklist that clearly lays out what needs to be accomplished in an organized fashion. As each item is completed, the item is checked off the list, so the customer knows where they are in the process.

Consider these design elements to improve the onboarding experience:

- Create a personalized experience based on the customer’s goals. For example, a customer opening a checking account will have different goals than a customer asking for a mortgage.

- Have the customer enter the pertinent information once and store it to be auto-filled into all forms.

- If you require the customer to share an ID, find a way to securely upload and store the identification.

2. Supporting an issue or dispute

Escalating an issue or dispute, such as a fraudulent credit card charge, can be one of the most trying experiences for a customer. It often involves numerous phone calls, emails, and chatbots to resolve the problem. This leads to endless frustration and a negative experience for customers.

Create a better user experience for your customers — and your employees — by efficiently offering support in the escalation of disputes. With Salesforce Financial Cloud, your employees will have a 360-degree view of the customer who is contacting them. They’ll have visibility into the customer’s data to access the information they need with guided processes and transparently designed workflows.

3. Mobile banking

According to the recent Insider Intelligence’s Mobile Banking Competitive Edge Study, 89% of respondents said they use mobile banking. Mobile banking crosses generations, with 97% of millennials, 91% of Gen Xers, and 79% of baby boomers indicating they see the benefits of mobile banking.

Typically, mobile users are looking to the bank’s website or app for the features that will save them the trip to the bank’s brick-and-mortar location or a phone call to the support center. These are the most valuable features on a mobile banking app and should be prioritized with UI/UX design to make them easily accessible:

- Mobile check deposit (35%)

- View statements and account balances (33%)

- Transfer funds (31%)

- Pay bills (28%)

It is no surprise the ability to deposit a check via mobile app is the number one feature. This may be because the user experience has improved over the years. Today, you usually snap a photo of the front and back of the check, but in years past, the process was less intuitive for the user, and the technology less reliable.

How Silverline can help

Silverline is a certified Salesforce partner that provides consulting, implementation services, and ongoing support. Our talented team of Salesforce experience design experts is here to help you maximize your financial organization’s look, feel, and function – and minimize making a multi-million dollar mistake! Find out how we can make your Salesforce experience more user-friendly.