Bank mergers and acquisitions are a big undertaking for financial institutions. They take months to years of planning and coordination that requires significant resourcing dedication that could potentially slow down other transformation initiatives.

There is an expected dramatic uptick in merger and acquisition activity in the American community banking sector, according to a recent report from investment manager FJ Capital. “Our expectations are that activity will begin to pick up in the first half of 2021 and accelerate through the year and continue to be robust over the next 3-5 years,” FJ Capital said. The firm suggests that the banking industry is approaching a “positive inflection point” in community and regional banks.

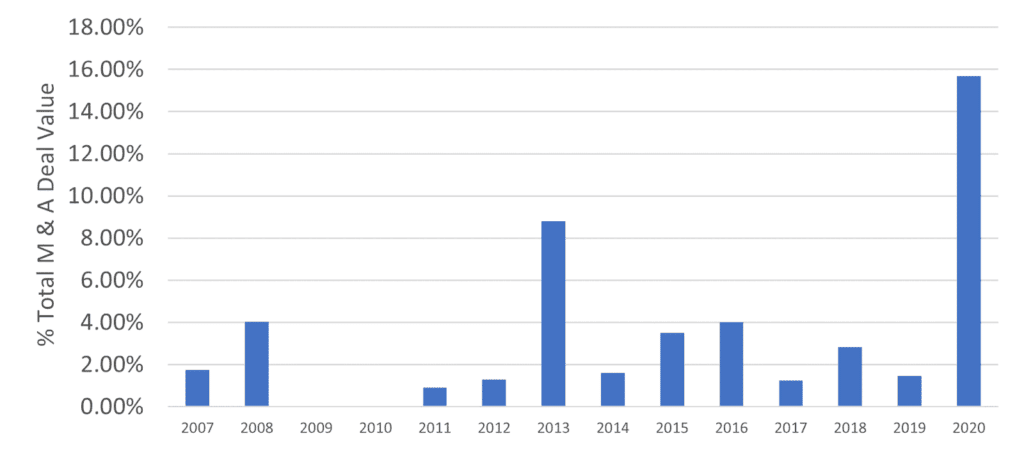

Trends outlined by S & P Global Market Intelligence support this report, highlighting the increase in deal value of community banking M&A over the last 12 years.

As these deals increase in frequency, it’s important that financial institutions have the tools in place to manage employee, member, customer, and stakeholder relationships and expectations.

How Salesforce supports community bank M&As

In my experience going through multiple acquisitions and one significant merger, leveraging Salesforce helped effectively manage the customer experience and internal operational needs during bank M&A activities. Specifically, Salesforce helped:

- manage merger related workflow

- efficiently onboard new team members

- execute personalized communication strategies to existing and new clients about progress, account impacts, and new benefits

If you’re looking to leverage Salesforce tools during a merger or acquisition, the following focus areas are a great place to start.

Process consistency and efficiency

Banking processes and procedures can be cumbersome and static. Consider Salesforce’s Knowledge Management tool for an intuitive source of truth for everything your associates need to know. In addition to the Knowledge Management tool, users can take advantage of Salesforce’s capability to incorporate persona-specific experiences that can be guided through the platform. From leads and opportunities with well-defined stages and sales paths, to in-app guidance, Salesforce can make a big impact during a stressful initiative.

Engagement Strategies

Salesforce and Marketing Cloud or Pardot can provide efficiency and transparency for the Marketing and Communications team for client communications, as well as internal communications. In addition to automated campaigns, Salesforce workflows can help recommend next steps and track follow-ups along with email or SMS communications. Einstein Next Best Action also complements efforts to personalize targeted activities.

Environments for Training and Data Synchronization

The other big value add is the ability to use full or partial Sandbox environments to move new associates into a training environment where new data could be synchronized and tested during training sessions.

In a previous role, my team was responsible for training and onboarding Commercial Bankers during an acquisition. Our sessions enabled the new associates to get hands on with the system starting on legal day one. In these sessions, we focused on learning the new combined organizations sales strategies, learning about all of the sales enablement tools and processes, and territory/relationship alignment.

This was a critical activity during conversion to align both organizations’ Commercial and Business Banking client overlaps and in process pipelines.

Speed and Agility

All of the above can be accomplished quickly and efficiently. While many critical resources are focused on conversion activities and change management, you can execute everything previously mentioned with a few skilled Salesforce admins.

In addition to being an agile and robust tool to support these efforts, Salesforce enables teams to collaborate, prioritize session feedback, and build a backlog of future business needs to align to a defined roadmap.

This allowed us to build trust and offer transparency around the way we operated during these sessions. We also gained insight into which initiatives were most valued by business leaders and what existing processes and tools impacted associates positively or negatively.

Silverline is here to help

Mergers and acquisitions will continue to be a big topic in 2021.

As noted in the FJ Capital reports, “Our expectations are that activity will begin to pick up in the first half of 2021 and accelerate through the year and continue to be robust over the next 3-5 years.” FJ Capital said.

Silverline can help you get the most out of your Salesforce program to support your shifting priorities and provide expert guidance on potential strategies you can leverage the platform beyond CRM.

Our experts in financial services and Salesforce technology are poised to help you connect and support employees, members, customers, and stakeholders during community banking M&As. Reach out today.