In early April, the Federal Reserve announced that it is working to establish a Main Street Lending Program (MSLP) to support lending to small and medium-sized businesses that were in sound financial condition before the onset of the COVID-19 pandemic.

Similar to the Paycheck Protection Program (PPP), this new program aims to help small businesses and employees in the U.S. that were in good financial standing but have since suffered financial hardship due to the Coronavirus outbreak.

On April 30, the scope of the previously announced Main Street Lending Program expanded. This expansion is due to the feedback the Fed received from the public. The expansion includes:

- An additional loan option with increased risk for lenders, bringing the program to three potential solutions

- Lowering the minimum loan size from $1,000,000 to $500,000

- Expanded the pool of eligible businesses

What this means for smaller businesses

The Main Street Lending Program (MSLP) will support credit flow to small and mid-sized sized businesses.

The program is aimed at creating up to $600 billion in loans for companies with up to 10,000 employees or up to $2.5 billion in 2019 sales — providing a great alternative for the mid-sized businesses who did not qualify for the PPP or the businesses who were unable to secure funds before they ran out.

The two biggest differences between the MSLP and the PPP are quite simple. First, the loans are actually loans and they must be fully repaid. And second, the details of the loans will be available for the public to view (borrower names, amounts, and pricing).

How the Main Street Lending Program works

In order to help banks lend to businesses in need of a loan, the Federal Reserve originally planned to buy 95% of the loan from the bank, eliminating most of the risk. To do so, the Federal Reserve will need funds. And the Treasury will offer up $75 billion in cash for the program with designated funds as part of the CARES Act established last month.

As of April 30, the Fed announced a third loan option that would require lenders to retain 15% on the “Priority” loans.

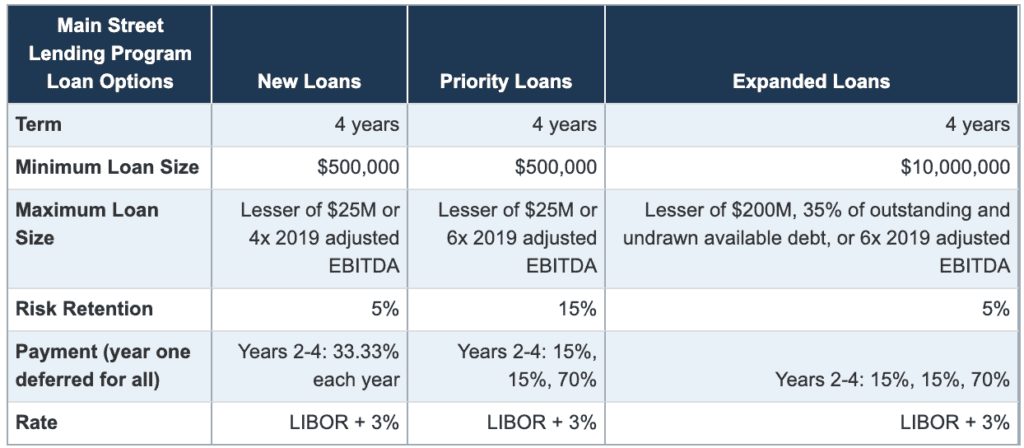

As we mentioned, the program now offers three (3) total loan options. The chart below summarizes the different loan options.

source

When will it be available?

The Federal Reserve is currently working to create the program infrastructure and is considering feedback provided by the public. Because the plan is still being shaped and guidelines finalized, it is not clear when the program will officially launch. The Federal Reserve hopes to launch the program soon.

More information regarding program terms and how eligible lenders can participate will be published as it becomes available.

What lenders can to do to prepare

Your customers still need help, and this gives you the opportunity to do so.

Lenders should be evaluating how they will engage with clients and prospects proactively. It will be important to have a plan in place before the calls start rolling in. Many lenders supported the PPP process with existing tools and manual solutions by aligning a significant amount of staff to executing the underwriting and origination process.

Outside of aligning additional associates to the program, lenders should be considering engagement solutions to proactively educate their clients on how they are preparing for the program, and developing FAQs that can be accessed on the web, online banking, or client facing communities. A recent survey showed 35% of people said they did not feel their primary financial institution had shown concern for their personal financial situation, whereas 32% said they had. Another 32% didn’t know.

While reallocating resources and creating new, manual solutions may be a quick fix — it isn’t a process built for longevity.

One way to build trust and show empathy while supporting your clients is to design application and servicing journeys to send notifications to applicants or interested parties on requirements, next steps, or where they can directly engage with an associate.

Here are a few ways you can build trust and show empathy while supporting your clients:

- Applicant Engagement Journeys

- Hardship Request Journeys

- Loan Servicing & Forgiveness Journeys

- FAQs

- Chat and Chatbot Solutions

- Digital Meeting Reservations to speak you banker/advisor

Why picking the right partner matters

In the midst of all this uncharted territory, implementing new solutions into your Salesforce Org might not be the best use of resources, and you might not have the time. We are working with clients today to implement engagement journeys for all of the above mentioned customer experiences. If you are already leveraging Salesforce’s suite of solutions, we can implement many of them within a few days or a couple of weeks.

We can also help improve your Salesforce experience by customizing Financial Services Cloud and its engagement tools in order to respond to the immediate needs of their communities during crisis situations. For example, we can help build out custom communities and facilitate call routing so the highest priority cases can be taken care of first. Whatever your needs, it’s important you have a partner you can trust — one who understands your unique situation, and those of your customers or members.

The sooner you’re prepared, the sooner you can take action to help. Reach out to see what Silverline can create for you.