Insurers can expect accelerated premium growth in the coming year. While other insurance sectors, such as cyber insurance, have seen rates soar by 25.5% due to ransomware attacks and breaches of remote work locations, only workers’ compensation showed a rate decrease, down an average of 1.74%. This is likely due to U.S. unemployment remaining higher compared to before the pandemic.

Premiums are highly relevant since the majority of workers’ compensation is sold through the broker network, and there’s still a lot of friction in the sales process there. You can’t just type in four pieces of data and get an estimate of what your quote is going to be.

Carriers have to track a variety of policy types and manage multiple policies for a single individual. They make use of a variety of workflows, processes, and systems to do so.

In order to move successfully through the workers’ compensation space, brokers have to collect a lot of data. In many cases it’s still a paper-based process. Once collected, the broker passes the data to the underwriting team to assess the risk and establish a premium — another cumbersome procedure that would benefit from automation.

Gather your data ahead of time

The data you can get from companies like Dunn & Bradstreet or ZoomInfo helps you better prepare for sales calls, meetings, or written communication. This data helps carriers and brokers know employee count, locations, DMV records, and more ahead of time.

By asking directed questions, you will be better informed about the client and can double check information. Provide the client with your data and let them correct you slightly, or not at all, rather than have them tell you something that takes time away from the deal. Even this process can be better automated with known data to prefill forms and make the entire process smoother.

With prefilled data, the broker can sell more because they’re able to focus on the conversation, not the transcription.

Digital transformation grows sales, improved profits fuel transformation

Quite often, workers’ compensation is sold along with other group benefits and commercial insurance products, such as cyber, excess casualty, dental, and more. When you’re building policies and adding coverage for more than just one type of product, it’s important not to keep that data siloed to individual products.

When everything is performed manually, there’s no connection that carries across all policies for one person or company. That siloed information — when pulled from spreadsheets, systems, file folders, and account databases — can take a long time to collect and isn’t informing you of better multi-line discounts and opportunities to upsell or add additional policies.

By digitizing forms, streamlining cross-sell and up-sell opportunities, and building out multi-line discount processes into one platform, your sales increase and your agents stay tasked on more valuable parts of their business.

The more you optimize, the more your business can grow.

Carriers no longer have the luxury to stand pat on outdated processes and systems. Brokers will do business with the carriers that move to more transparent, easier to use systems and give them a more frictionless way to transact their business.

Brokers and insurance agencies can accelerate their increased profits by streamlining their processes with digital transformation.

Providing great service

What specific technologies are going to enable exceptional engagements? What techniques will help you stand out from the rest? What people, processes, and tools will take you and your brokers to the next level?

First, understand your customers

Like any aspect of the insurance industry, workers’ compensation is a fast-paced business.

Customers file claims when they need the benefit of their policy. When your interaction is already starting from a place of negative experience, it’s paramount that the service you provide is a positive one.

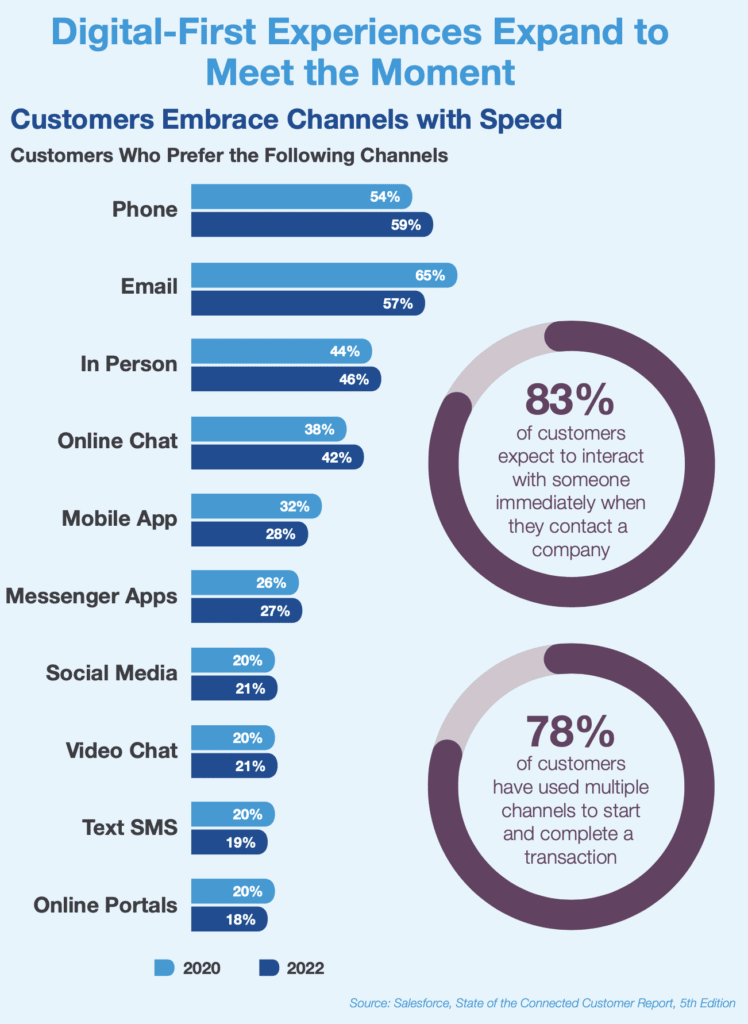

Policyholders need answers and results quickly. Faster and more efficient processes (forms, strategies, etc.) improve the experience for brokers and policyholders alike. According to Salesforce’s State of the Connected Customer report, 5th edition, 83% of customers expect to engage with someone immediately when contacting a company — up from 78% in the previous year. Tools that help proactively manage the policyholders’ expectations are key when navigating such nuanced engagement opportunities.

Self-service reigns supreme

The world is moving toward self-service capabilities. Insurance firms and workers’ compensation providers aren’t immune to the changing of times.

The benefit of self-service portals is more than just convenience of use for customers — there is a substantial positive impact on operational cost. With an easier-to-use system, companies are more likely to improve long-term retention rates for employees. Training materials can be shared and stored within the platform, making it easier for employees to access the information they need, right when they need it.

Salesforce Industries’ OmniStudio is a solution provided through Financial Services Cloud that enables claims and service transactions to occur online. With a self-service portal, customers can start the process themselves rather than call a 800 number or visit an agent in person. They can access their specific portal and choose to file a claim, learn more about the status of existing claims, or make a change in their coverage.

These processes can be reused by the service center and broader operations staff as well, providing faster speed to value and lower costs.

Brokers can also take the information provided to update the policy, and a contact center agent will have a clear path to enter data so the system can reprice a policy. Using these Salesforce Industries capabilities on the platform provides a smooth user experience all around.

Enabling workplace safety visits and training

With Field Service Lightning capabilities, scheduling and following up on workplace safety visits can all be accomplished in one place. Outcomes and action items can be uploaded to the portal after each visit, and users can review the results of previous visits with report tracking and analysis functionality in the customer portal.

Whether pulling forms, setting up internal meetings, or sending prep content to the client, getting ready for safety visits can be automated and facilitated through the self-service portal.

Relevant safety content stored within the portal can be tagged by industry, so the policyholders can see only content required for them. Training can be provided through Trailhead, with reminders and assignments added into the platform for ease of use.

Responding to patterns in renewals

The renewal process should start long before the renewal date. Salesforce can help automate and streamline the process by adding additional data points.

Forecast needs before they’re needed

Carriers should be thinking about a marketing automation journey that starts prior to the renewal period to prepare the policyholder for the process and invite them into the portal. The portal can run quotes and provide Next Best Offer-generated quotes, giving the broker better information to help the carrier facilitate the renewal process.

The agent/broker and policyholder portals can be configured to digitally facilitate discussion between them in a secured fashion.

Policy tracking

There is often a renewal component in which carriers share insights with brokers about policy performance. These conversations take HIPAA concerns into account, scrubbing any identifiable data from reports. Carriers should proactively suggest new or different product features, creating options for the broker upon renewal. Those options should factor in policy coverages, carrier profitability, and broker commissions — maximizing the combination to the benefit of all.

Bringing it all together

To provide a seamless and efficient policyholder experience, insurance systems need to communicate with each other. Systems must be able to store, share, and make use of the same data. Data needs to flow from the initial collection of information through underwriting to policy administration and claims, which reduces cost, complexity, and opportunity for errors.

Connect your data

Having all departments and customers using the same solution and data for intake, underwriting, processing, servicing, and claims provides tremendous benefits, including cost savings, improved customer satisfaction, and reduced handling times.

In a single portal, claims adjusters can:

- Manage all expense activity and financial transactions

- Easily set up claims line items by category with associated coverages, payees, inputs, and approval/denial reason codes

- View in-process claims, trailing document status, and activity history

- Manage expenses, losses, and reserves through a Financial Summary dashboard

- Upload documents through a drag-and-drop interface and receive alerts and reminders for outstanding requirements

Align your platform

Designed to work with Salesforce Financial Services Cloud, Salesforce Insurance Claims is a digital platform that allows insurers to overcome legacy constraints and transform their businesses for the modern age. By improving your tech stack experience, you can reduce loss-adjustment expenses by more than 20%, and improve customer satisfaction by up to 30%.

Salesforce provides end-to-end claims management in the cloud to replace fragmented manual processes with a streamlined digital approach — all with little to no code required. Salesforce seamlessly integrates the customer’s claims journey into their broader relationship:

- Give your policyholders dynamic, user-friendly FNOL experiences with minimal typing required

- Get real-time coverage verification and product or peril-specific question sets

- Upload documents and photos from any device and easily search for repair shops and other third-party providers

- Set up payments to one or multiple destinations via check or electronic payments

- Receive instant rules-based auto-adjudication and monitor in-process claims and payment status

- Support your claimants’ emotional journey through their loss with digital communication journeys

Silverline understands this landscape

Silverline can assist in optimizing your insurance business capabilities, but more importantly, we can help accelerate your digital transformation to ease you through the challenges ahead.

We’ve developed a strong core of consultants with experience in workers’ compensation. This deep industry knowledge, paired with proven Salesforce expertise, positions us to best help your company increase productivity, manage pipelines, drive renewals, target cross-sell opportunities, and close more business.

Contact us for an exploratory discussion to see how we can help improve your workers’ compensation strategy, architect your Salesforce implementation, or provide managed services.