You’ve seen how data storytelling helps companies deepen customer relationships and started to establish a data storytelling foundation for your organization, but how do you build a team that can effectively execute your data strategy?

To make this kind of data storytelling happen, financial services firms need to take cues from their friends in technology and build their muscles around three key skills: product management, user experience design, and change management.

1. Product management

Traditional finance companies are looking more and more like technology firms as they invest in product design and product management thinking. This means thinking about your business holistically, with the customer at the center.

This also means you need a central team that manages your technology, and specifically your Salesforce instance. With our clients, one of the biggest early indicators that an implementation project will be successful is when they have a dedicated product owner or product manager ready to go. This may be a technical role such as a Salesforce administrator, but it doesn’t have to be. What matters is less about technical expertise and more about mindshare and leadership, especially if you’re approaching a new implementation or Salesforce data storytelling project.

Your product owner is a critical role responsible for ensuring that your priorities align with the overall vision for your implementation project. They have the skills to successfully navigate multiple stakeholders, changing technological requirements, and lead project managers, engineers, and external partners to the finish line.

This includes day-to-day operations like:

- Working with executive sponsors to prioritize the most important work

- Understanding personas and key customer pain points or jobs to be done

- Charting a product roadmap and milestones

- Determining change management and training plans

- Managing improvements and new releases

To be able to deliver personalized, real-time experiences that your customers expect, you have to focus on small, meaningful, measurable experiments that have clearly defined personas, jobs to be done, KPIs to measure, and qualitative feedback to gather. Building feedback loops into your regular operations — whether through focus groups or 1:1 customer interviews, regular NPS surveys, or behavioral data — is essential to continue to grow.

2. Experience design

All of that feedback flows into a renewed focus on the client experience for financial services companies. Design used to be a nice-to-have element of your website, but it’s now an essential piece of how your customers interact with you.

The average customer spends 67% more in months 31-36 of their relationship than in their first six months. And 33% of Americans say they’ll consider switching companies after just a single instance of poor service.

You’ve probably spent hours and hours training your staff and thinking through tiny details like which mints are offered at the beginning of a meeting and what music plays in the lobby of your office. You need that same attention to detail when thinking about your client’s journey, too.

Ask yourself:

- What points of friction exist in your customer or policyholder journey? Examine how easy your quoting process is to navigate from your customer’s perspective. These are the points in the customer journey that add too much complexity and cause frustration. A better customer experience starts with simplicity.

- Are you where your customers are? Consider expanding your service channels. While traditional phone-based contact centers aren’t going away, customers want more options to engage with you when they have coverage questions, claims, and other service needs. Chat and text channels are becoming increasingly popular. In addition to giving your customers more options in getting questions answered, using live chat or chatbot technology can aid with call deflection and responding to simple customer requests such as payment date, claim status, and document requests.

- Is it easy for your employees to help your customers? It’s no secret that financial services firms are struggling to retain their staff to tech companies. And while more money and better hours may be one factor, it’s also the way that tech companies empower their organizations with data and easy-to-use software. They’re not constantly swiveling between channels — making it much easier to get their jobs done and help their customers when they need it.

All of this can be solved with better experience design and a focus on the data needed to drive top-notch experiences. By paying attention to what your team members do every day, and how you can make that experience easier for them, you can reap big dividends on time and client satisfaction. The smoother and more automated your workflow is, the more likely you’ll be able to deliver on that promise to your clients of the right person, right time, right channel.

3. Managing and navigating periods of growth and change

Change is hard.

Financial services firms need dedicated change management skills to manage the constant shifts externally in the market and internally within their organizations. Done right, change management builds sustained momentum so that your team feels engaged, supported, and heard as they embark upon using a new system — and empowered to provide feedback at every step. You want to keep up the momentum you’ve achieved with planning and implementing.

Change management is part of the broader discipline of organizational change management (OCM), designed to successfully navigate employees through any change. In practice, this means managing the thoughts and feelings of individuals undergoing change in a business setting and driving the behaviors which are best suited to successfully adapt and benefit from the change. This ensures successful adoption of new technology and achievement of your organization’s defined business objectives.

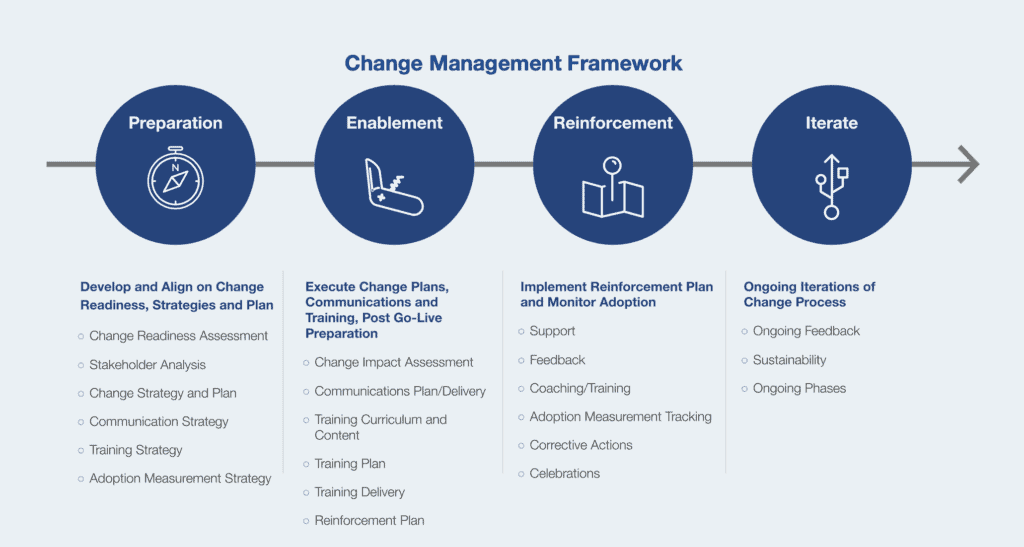

The framework for successful change management comes down to three phases:

- Preparation: planning, team development, discovery, stakeholder identification, analysis, engagement, and assessing change readiness

- Execution: detailed stakeholder analysis, role and process change impact, communications, training, and reinforcement planning

- Reinforcement: ongoing support and training, monitoring outcomes and adoption, feedback and enhancements, and of course, celebrating a job well done

Why does it matter? A successful project is not only on time and budget, but results in delighted, productive users who realize expected benefits. Successful change management can:

- Ensure adoption and usage

- Increase likelihood of true project success

- Achieve desired business objectives and outcomes

- Reinforce focus on employees — both in their buy-in and on a smooth transition

- Increase ability to serve customers, better fostering client satisfaction and loyalty

- Minimize risks and related costs

On the flip side, not managing change can create costly risks, including decreased productivity, increased spend, and dissatisfied employees and/or customers. Without change management, a project can work on a technical level, but it can easily fail without the proper care and feeding of the people involved. This focus on people is where the value of change management lies.

Prepare for the future of data with Silverline and Salesforce

If your firm needs help with operational strategy, planning for your integration and security initiatives, or building out your data storytelling roadmap, Silverline is here to help. Our team of experts are ready to build value for your organization and would be glad to have a discussion about where your firm currently stands. No matter where you are in your Salesforce journey, we can help you find your way forward. Learn more about what our team of experts can do for your organization.