Reading Time: 3 minutes

Look up “volatile” in the thesaurus, and you’ll likely see synonyms like unstable, unpredictable, and precarious – all of which are perfect adjectives for the flux of today’s markets. Rising inflation and other financial crises are wreaking havoc on the interest rate environment and impacting the insurance industry.

Rates had been at historic lows, but in 2022 they began to rise rapidly. Financial and professional liability insurance lines experienced the most significant rate deceleration, from 40% in the third quarter of 2020 to 1% in the third quarter of 2022. Global property catastrophe reinsurance rates increased by 37% in January 2023 renewals, the largest increase since 1992, with implications for primary rates to follow.

So, what’s an insurance company to do in a highly volatile market when you must compete on more than just price? You lean into your brand marketing and enable your insurance agents with on-brand, personalized messages that help deliver a better customer experience that prioritizes relationships over price.

Differentiate insurance brands with distributed marketing

Distributed marketing aims to bridge the gap between your insurance organization’s corporate marketing and your many partners, agents, or anyone that interacts with your brand to deliver a consistent message and experience across all your marketing touchpoints.

Salesforce Marketing Cloud enables the content collaboration needed for successful distributed marketing in an agency model. Insurance companies create on-brand content in Marketing Cloud, and partners and agents can view, personalize, and send this content at scale. They can maintain corporate-level brand standards and legal compliance with privacy policies with automated and manual approval processes – all while empowering the extensive workforces under their marketing umbrella.

These are a few ways that Marketing Cloud helps solve marketing challenges for insurance organizations:

- Use structured brand templates for client communications with the option for agents or partners to personalize materials with their own text, images, or offers.

- Automate the opt-out process to make sure corporate standards are followed but do not stand in the way of an agent trying to get an email out efficiently.

- Strike a balance between generalization and personalization in marketing communications by controlling the ability to update content while staying on brand.

- Leverage the power of connected data between Marketing Cloud and your core systems to communicate results and put checks and balances in place to create a fluid and easy process between marketing and sales.

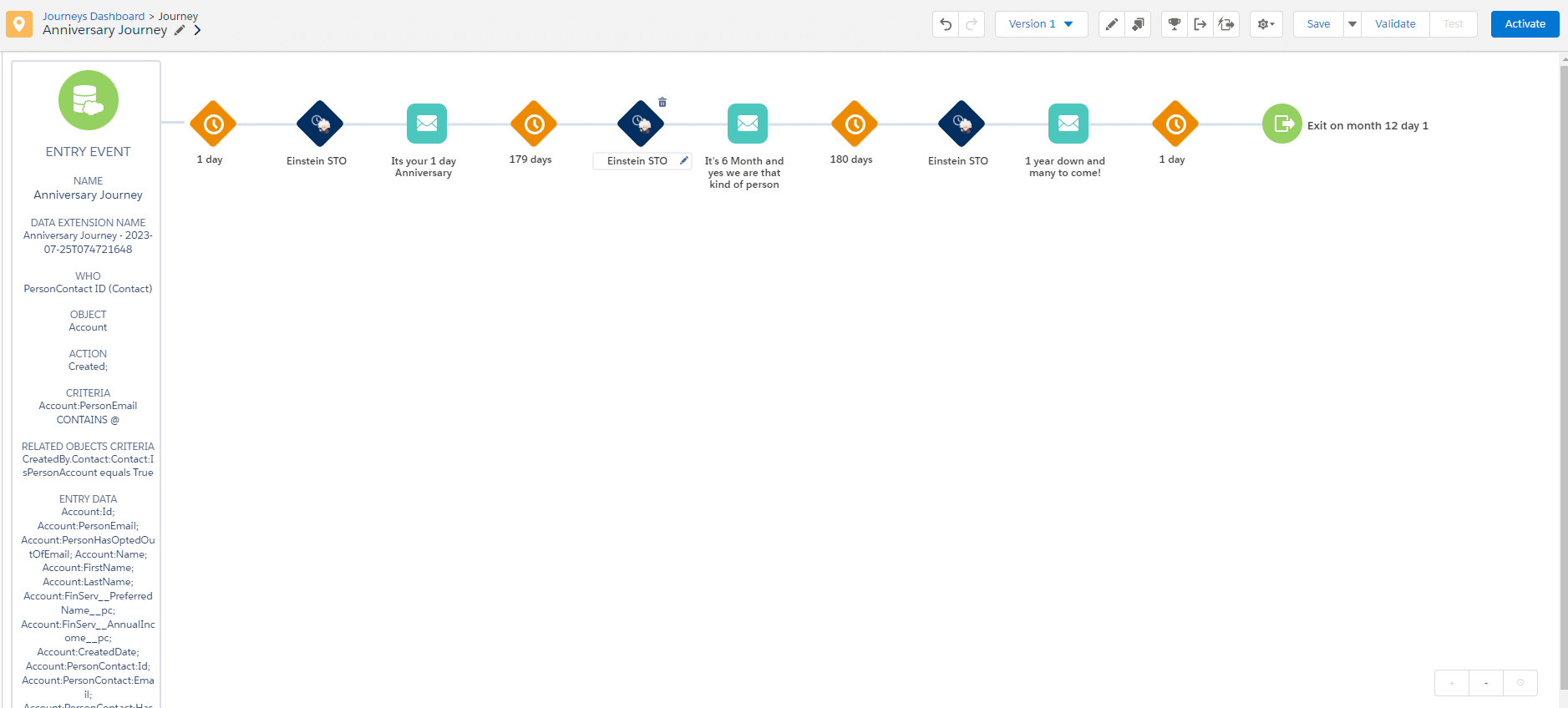

Creating distributed marketing customer journeys

The bonus of distributed marketing with Marketing Cloud is that your partners and agents can connect with their customers and independently manage their marketing efforts without all the back-and-forth. Distributed marketing helps insurance companies create automated and personalized customer journeys to which your agents and partners can quickly add customers.

Here are some ideas of customer journeys that agents can shift from generic to hyper-personalized based on their customer profiles:

- Birthdays

- Anniversaries

- Lead nurturing

- Services follow-ups

- Policy renewals

The best part of journeys? The customers get a personalized message for one-to-one engagement and an improved experience. The agents move closer to a sale and save time in the process. It’s a set-it-and-forget-it approach where everyone wins.

Begin your journey with Silverline

Silverline’s team leverages insight acquired through 10+ years in the business, thousands of engagements, and real-world expertise gained across the Financial Services industry. From strategy and implementation to managed services, we enable success with the Salesforce platform so you can achieve continuous value in orchestrating your customer journeys. Find out how Silverline can help your insurance organization leverage Salesforce Marketing Cloud to compete in volatile markets.