As consumer technology trains us to expect instant results, that same mentality carries over to the workplace. Everyone wants things, and they want them now, whether that’s an interactive dashboard about the portfolio of live deals and staffing assignments, a balance sheet from a portfolio company’s last valuation, or maybe just a cup of coffee to get through the work day. The expectation is that we will have the same interaction, engagement, and speed as in our personal lives.

What Salesforce does is provide a great foundation to make it happen. It enables a powerful productivity and insights-driven technology experience, much like we’ve come to expect with our consumer apps. And it does it through clicks, not code.

In 2021, Silverline was excited to be a Salesforce launch partner for Financial Services Cloud for Corporate Investment Banking. FSC for CIB brings your entire organization into a single, secure platform. It is designed to grow with you and your private equity partners, consultants, target companies, and partners.

These are some of the Salesforce Financial Services Cloud features we’re most excited about that can help investment banks manage pipeline, generate market insights, and create great client experiences as they grow.

Interaction Summaries

Salesforce has productized two solutions to common problems that growing companies face with their client interactions. These newer features allow you to not only visualize your data, but also act on it.

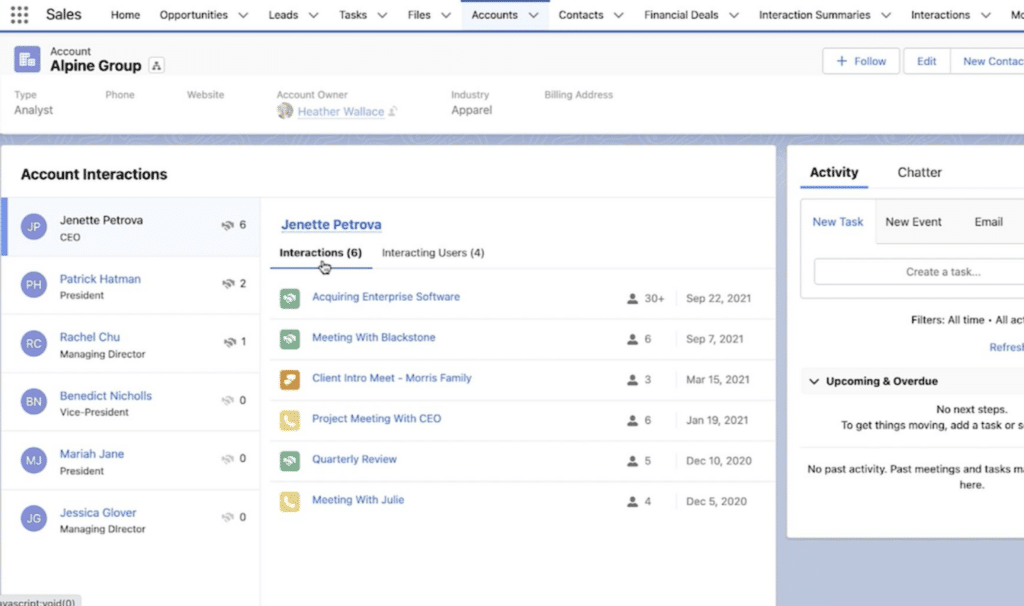

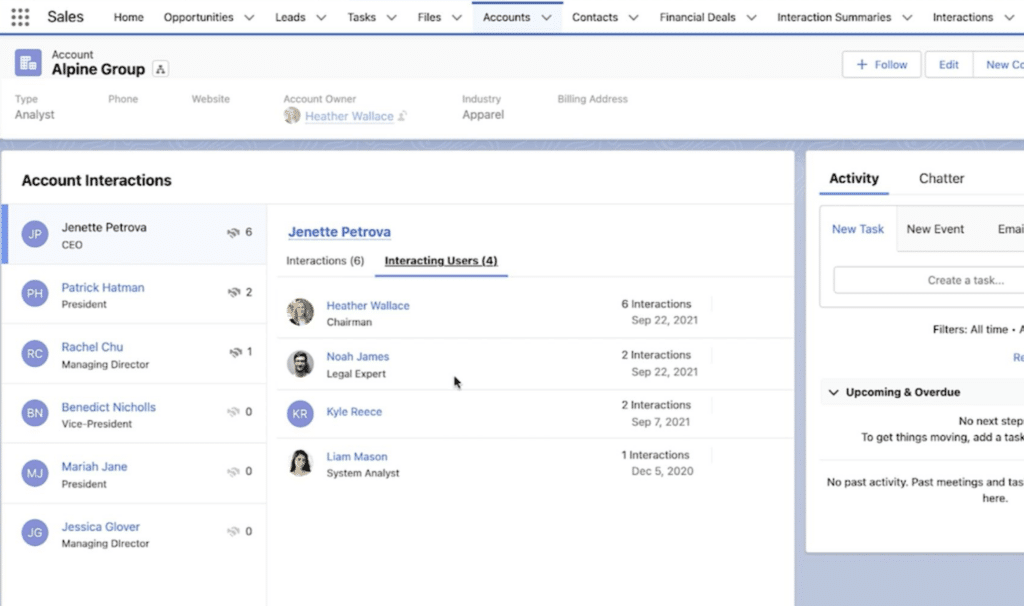

With interaction summaries, investment banking teams can take detailed meeting notes, specify the confidentiality level of the notes, and add action items or next steps. They can maintain compliance by sharing notes that contain confidential information only with relevant stakeholders. Before their next meeting, they can quickly search or filter interaction summaries to find and review past client meeting information. The interactions intel can be viewed both from the contact and from the company for full 360-degree visibility.

Plus, Salesforce does some of the heavy lifting through automation: each attendee’s company is automatically captured, making it easy to view and report on all meeting traffic. Company and contact roles can then be set (legal, audit, primary, etc.) to deepen the data analysis and relationship capturing.

To even further increase productivity and efficiency, the new Spring 2023 release of FSC for CIB helps you leverage Outlook integration functionality to automatically sync events from your calendar to Salesforce. These interactions and attendee records make event tracking seamless and help users avoid entering data manually.

Relationship Heatmaps

The interaction summaries pair well with the relationship heatmap. The data-driven heatmap increases visibility into client connections and meetings that are taking place. Relationships are weighted on the map to see where your strengths and weaknesses lie. Managing Directors and firm leaders can triangulate who on their team has the best relationship with a CEO, who may be looking for a capital raise, or who knows the CFO of a company going through a restructuring process.

Actionable Relationship Center

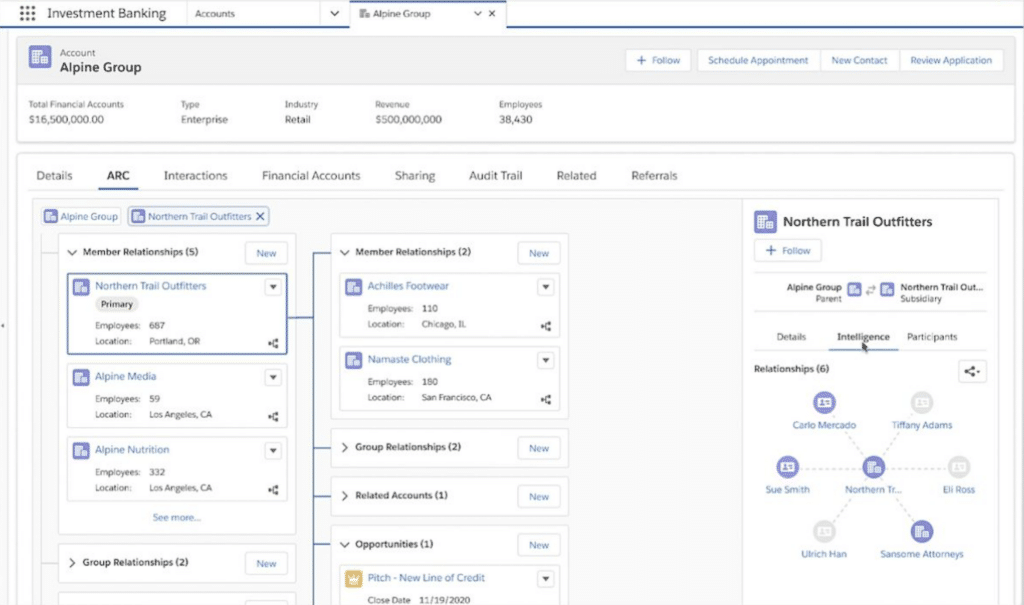

In addition to the interaction reporting and relationship heatmaps, Salesforce provides an Actionable Relationship Center (ARC) to help your team visualize and update all the relationships that might exist across a company’s complex hierarchy. Subsidiary accounts and legal entities, board members and key relationships, and other associated deal-related records can be displayed in one convenient interface. ARC helps bankers see the complex relationships they manage through a single pane of glass.

The ARC does nearly everything the Relationship Heatmap component can do – and then some. The power of ARC helps bankers view related data like the history of client interactions, previous pitches, and closed transactions. This feature helps immensely because as a firm grows, its volume of data increases exponentially. Month after month, it becomes a massive operational challenge for firms to sort through the data for something as simple as finding out when the last meeting took place, or when the last portfolio valuation happened.

With the latest Spring 2023 FSC for CIB release, Salesforce allows teams to take action straight from ARC, offering bankers a guided path for completing business processes, quick actions to schedule tasks or other reminders, or even add key relationships to marketing campaigns and newsletters. These quick actions help create a seamless experience for bankers to take action on the data they see.

Investment Summaries

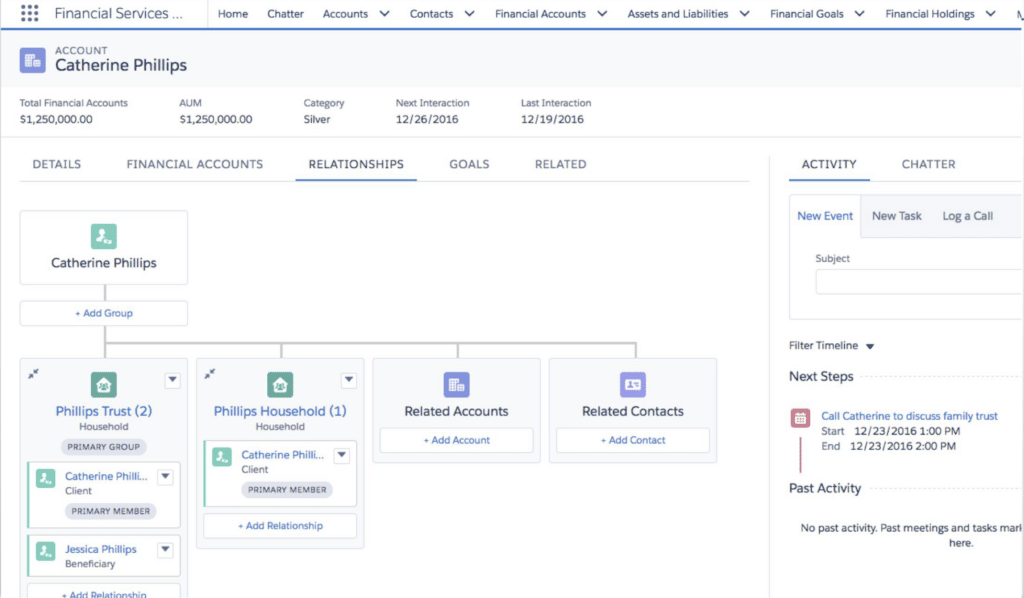

As investment banks and asset managers grow, they naturally extend their business model into other areas such as high net worth wealth management and alternative lending. Transactions become full white-glove client service with executives and management teams.

While the Investment Summaries feature of Financial Services Cloud was originally designed to help firms roll up a synopsis of personal investments and AUM, forward-thinking investment banks use this technology to help their Financial Sponsor Coverage teams visualize the portfolio investments and market data insights of their key relationships. This FSC for CIB capability provides interactive views and roll-ups to help teams visualize their first-party, second-party, and third-party market data – and where they might source their next transaction.

Actionable Segmentation

In investment banking, It is crucial to reach out to the right people at the right moment. A great CRM allows users not only to view the data they need, but to act on it effectively. Actionable Segmentation in FSC for CIB enables users to build meaningful client segmentation filters and apply them to the actionable lists. This new list functionality aims to help bankers define who they need to contact first to achieve meaningful and timely outreach – and it provides contextual guidance for that outreach.

Silverline knows Investment Banks

If you are an investment bank or research, sales, or trading firm that leverages Salesforce, you need a partner that can help your technology stack keep pace with your growth.

Silverline’s expertise with capital markets firms, coupled with our vast Salesforce experience, uniquely positions us to implement the right tools to drive operational success. Our team is a brain trust of industry strategy with over a decade of experience consulting in the capital markets space. Download our eBook to learn more about how we can help you evolve and scale with Salesforce in and beyond.