2021 proved to be a banner year for Canadian investments, with more than $11.8B CAD in venture capital invested and $20B CAD in private equity deployed. Canadian startups raised more than double their 2020 investment totals, and 2x the totals in 2019.

Canadian economic development is positioned to see parabolic returns, but what does that growth mean for busy operations and technology executives? They face a huge demand for intelligent applications that can power their investment pipeline and create efficient middle and back-office workflows.

Let’s take a look at what’s next for market data in Canada and how private equity and venture capital firms can supercharge their business and relationship intelligence, accelerate investment cycles, and win with Salesforce tools.

Canadian capital markets are on the up and up

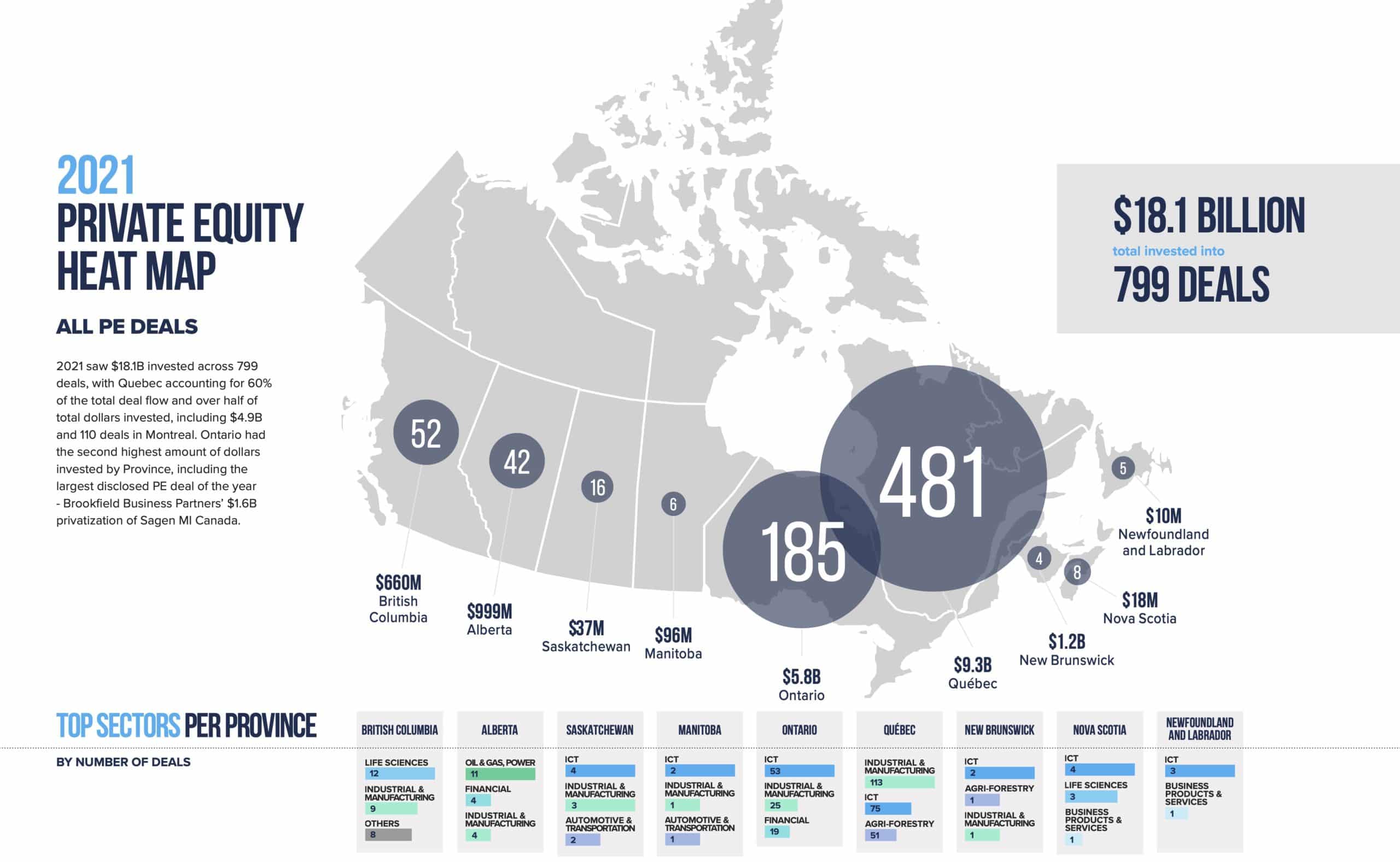

There has been a considerable upswing in investment growth in Canada, even amidst broader market volatility. The Canadian Venture Capital & Private Equity Association (CVCA) recently shared its 2021 year in review. It showed investment and deals returning to levels on par with pre-pandemic and the five-year average. The review’s positive outtakes included:

- 2021 saw the highest private equity deal count on record, 21% higher than the previous record in 2019.

- The strongest sectors were FinTech (+1412% in dollars invested), Business Products and Services (+312%), and Cleantech (+189%).

- 84% of all private equity deals were under $25M CAD, highlighting the strong market for Canadian investment in small and mid-cap companies – considered the backbone of the Canadian economy.

- Venture capital investment momentum continued in 2021 Q4 ($2.4B CAD across 183 deals), pushing the 2021 year-end total to a record-breaking $14.2B CAD invested across 751 deals – more than 2x the record set in 2019 ($6.2B CAD across 539 deals).

There is no question that private investment in Canada is growing. But with growth, so too arises the need for productivity and performance insights. Deal staffing, investment committee requirements, executive search, and portfolio operations are just a few of the operations impacted by an investment team’s stellar growth. It is often the technology and analytics teams that are hit the hardest.

So, how are top PE and VC firms in Canada, or anywhere for that matter, supposed to sustain themselves and keep a strong foundation as they scale? It starts with having the right tools and platforms in place to support growth and expansion.

Salesforce accelerates transformation at scale

As consumer technology has trained us to expect instant results, so too has that same mentality carried over to the workplace. Everyone wants things, and they want them now, whether that’s an interactive dashboard about the portfolio, a balance sheet from a portfolio company’s last valuation, or maybe just a cup of coffee to get through the work day. The expectation is that we will have the same interaction, engagement, and speed as in our personal lives.

What Salesforce does is provide a great foundation to make it happen. It enables a powerful productivity and insights-driven technology experience, much like we’ve come to expect with our consumer apps. And it does it through clicks, not code.

Salesforce Financial Services Cloud brings your entire organization into a single, secure platform. It is designed to grow with you and your LPs, consultants, portfolio companies, and partners. These are some of the Salesforce Financial Services Cloud features we’re most excited about at Silverline that can help private equity and venture capital firms manage investment data, generate market insights, and create great experiences as they grow.

Interaction Summaries and Relationship Heatmap

Salesforce has productized two solutions to common problems that growing companies face with their client interactions. These newer features allow you to not only visualize your data, but also act on it.

With interaction summaries, PE and VC teams can take detailed meeting notes, specify the confidentiality level of the notes, and add action items or next steps. They can share notes that contain confidential information only with relevant stakeholders to maintain compliance. Before their next meeting, they can quickly search or filter interaction summaries to find and review past client meeting information.

The interaction summaries tend to pair well with the relationship heatmap. The data-driven heatmap increases visibility into the client connections and meetings that are taking place. Relationships are weighted on the map to see where your strengths and weaknesses lie. Sales leaders can triangulate who on their team has the best relationship with a CEO looking for a capital infusion or identifying a company going through a restructuring.

Actionable Relationship Center

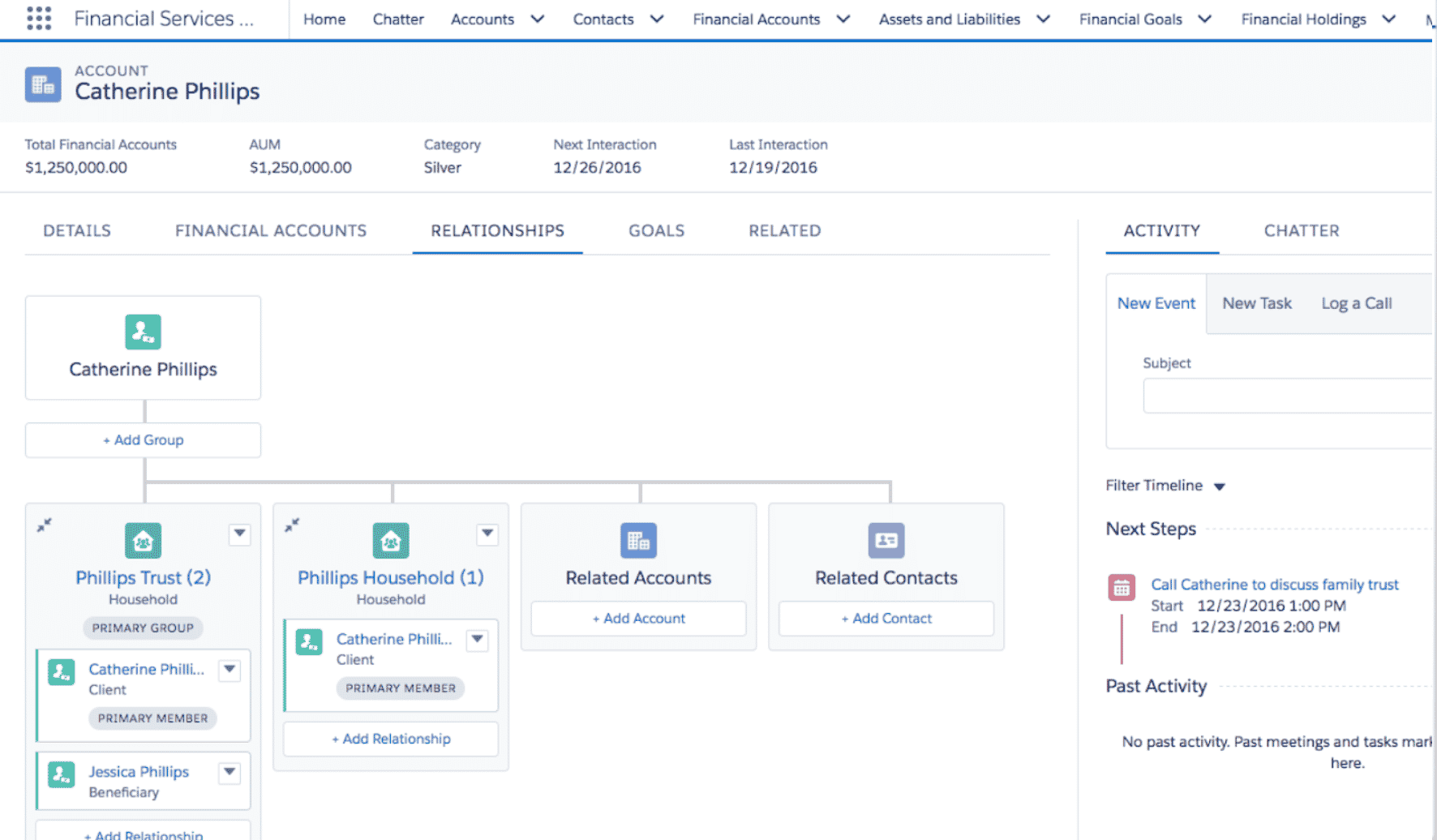

By using the Actionable Relationship Center (ARC) feature, your team can create and edit accounts, contact relationships, and other associated records in one convenient interface. ARC displays complex relationships and related lists at-a-glance.

The ARC does nearly everything the Relationship Heatmap component can do and also displays related lists. It allows you to see a history of client interactions in a single pane and use it to decide the most efficient way forward. This feature is relevant because as a firm grows, its volume of data increases exponentially. Month after month, it becomes a massive operational challenge for firms to sort through the data for something as simple as finding out when the last meeting took place, or when the last portfolio valuation happened.

Investment Summaries

As investment banks and asset managers grow, they naturally extend their business model into other areas such as high net worth wealth management and direct lending. Transactions become full white-glove client service with executives and management teams.

While the Investment Summaries feature of Financial Services Cloud was designed to help firms roll up a synopsis of personal investments and AUM, it can also be used to visualize portfolio investments and market data insights. It provides interactive views and roll-ups to help teams visualize their first-party, second-party, and third-party market data

Silverline knows the Canadian capital markets

If you are a private equity or venture capital firm in the Canadian market, you need a partner that can help you keep pace with your growth.

Silverline’s expertise with Canadian capital markets firms, coupled with our vast Salesforce experience, uniquely positions us to implement the right tools to drive operational success. Our team is a brain trust of industry strategy with over a decade of experience consulting in the capital markets space. Watch our recent webinar to learn more about how we can help you evolve and scale with Salesforce in Canada and beyond.