The insurance industry is dealing with a major talent gap. According to the U.S. Bureau of Labor Statistics, nearly 400,000 employees are expected to retire from the insurance industry workforce within the next few years.

Yet, those people that were supposed to follow in retirees’ footsteps are choosing a different path. 44% of millennials say they do not find a career in insurance interesting. Eight out of 10 millennials report having limited knowledge and understanding of the employment opportunities available within the insurance industry, possibly due to the fact that this generation may not see much need for insurance.

So, what’s an insurance company to do about its widening talent gap? Especially when customer expectations of its agents continue to accelerate, and there is no one available to meet those needs.

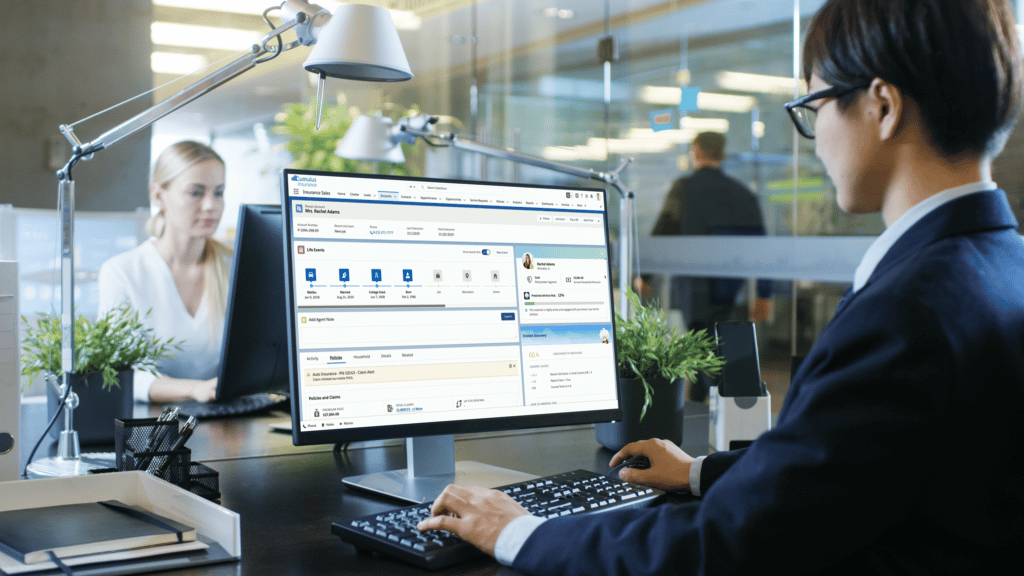

Some are turning to technology, which has brought new innovations to a somewhat outdated industry. Digital transformation is sweeping across the sector and bringing with it better experiences for customers and employees alike.

Underwriting shifts to automation

Underwriters play a vital role throughout the insurance processing pipeline, from gathering the essential information on the front end to approving or denying on the back end. But unfortunately, underwriters are one of the insurance roles most impacted by the talent shortage.

Insurers are having to shift their thinking about how they use their systems for underwriting decision-making to prevent a bottleneck of policies backing up the pipeline. They are integrating additional technology and automation elements into their infrastructure in the hopes that this will reduce their underwriters’ time and increase their efficiency.

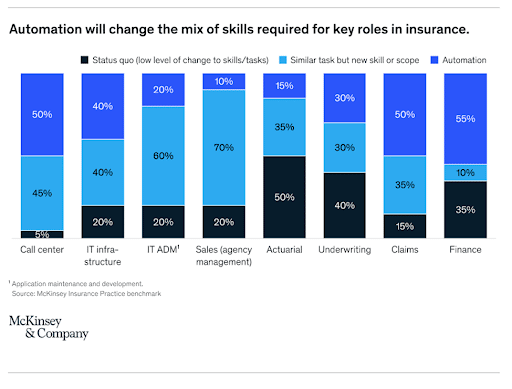

According to McKinsey, automation will change the mix of skills needed for key roles in insurance. McKinsey profiled roles at leading insurance companies in Europe and the United States, including underwriting, actuarial, claims, finance, and operations roles, and discovered that a significant percentage of these functions could be automated over the next 10 years.

For underwriters, in particular, McKinsey predicts that 30% of the role will be automated, 30% will be similar tasks but with new skills or scope, and 40% will stay status quo with a low level of change.

Rebuilding an insurance quoting process for efficiency and visibility

Too many insurance companies are still relying on legacy policy systems that are highly manual and sometimes involve such “high-tech” features as sticky notes or – gasp! – faxes. They don’t want to get rid of their old-school policy systems, but they do want to update their quote systems to better meet customer needs.

Since so much information is exchanged between the potential policyholder and the insurer during quoting, having less back-and-forth makes it easier for everyone. Insurers must have the ability to quote and be ready to bind while limiting the involvement of an underwriter or another essential employee. This low-touch, automated approach still lets the underwriter assess the risk of the policy, but it also provides them with better access to the data they need to accelerate their decision-making.

An example of this approach is Silverline’s partnership with a U.S. Workers’ Compensation Insurance Company (WCIC). This WCIC has helped employers protect injured workers, improve on-the-job safety, and reduce injury claims for over 100 years. But their processes hadn’t changed much in that time.

Requesting a WCIC quote was a time-consuming process by either mail or phone and offered no visibility into where quotes were in the issuing process. Brokers could call an underwriter and request a quote, which would require the underwriter to gather all the information and manually price the policy. If there was missing information, an underwriter would need to send a paper letter or e-mail to track it down.

Silverline worked with the WCIC to create the first Salesforce broker-facing portal with automated quoting and underwriting with complex group benefits. Silverline built a “Touch Tree,” a central point to jump back to as data is entered. The application navigation module broke down each part of the application process. Hence, no matter where the agent or underwriter moved in the application process, they always have the “Touch Tree” to come back to and show them where to go next.

WCIC’s quoting portal has dramatically advanced its quoting system. The average quoting duration has gone from six days to under an hour, with WCIC quickly approaching the final goal of less than 20 minutes to issue a quote.

Driving innovation with Silverline and Salesforce

Silverline is continuing to innovate with Salesforce in the insurance space. It has recently built and developed a Salesforce capability to provide multiple quotes. In the past, agents would only be able to provide customers with one quote. If multiple tweaks were made to the quote, agents would often use those aforementioned sticky notes to log the pricing because they didn’t want to reinput all the information and repeat the process again.

Now agents can quickly and simply regenerate a second quote with different parameters. Very few software packages for other industries offer this Salesforce feature. It has been a time saver for insurance organizations looking to provide a seamless experience for customers.

Salesforce recently announced its spring 2022 release for the insurance industry. Some of the innovative highlights include:

- Rating engine: The Expression Sets, a step-by-step algorithmic engine for defining rating logic, has new caching support to speed execution time and calculate across sets with Aggregation Steps. The Decision Matrices are optimized for set up and administration with Multicolumn Search to find data quicker, Column Sort to visually organize data, and Column Wildcards to reduce version size and complexity.

- Commercial quoting: New and improved UX components are designed for ease of configuration and a more intuitive experience. Quoting and policy lightning web components have a deeper hierarchical view of insured items and coverage to easily configure, reprice, and navigate complex quotes and policies.

- Claim payment management: Configurable Rules, States, and Actions over claims payments enable users to initiate workflows based on specific payment status. Now agents can embed cancel payment functionality within payment state actions using the new Cancel Payment Service.

- Analytics and dashboards: The Claim Department Performance Dashboard offers more visibility to monitor historical claim performance by the line of business and departmet for a top-down view. The Group Benefits Admin Dashboard enables group admin visibility into group data such as enrollments per product/plan, active enrollments per group, and member demographics per group by age or smoker status.

Innovating with Silverline

At Silverline, we have a strong core of consultants with experience working in Property & Casualty and Life & Annuity for both personal and commercial lines. This deep industry knowledge paired with proven Salesforce expertise positions us to best help your company drive digital innovation. Our solutions are built on the foundation of Salesforce’s Financial Services Cloud combined with leading insurance systems such as Salesforce Industries, Guidewire, Duck Creek, and Epic to offer you services from strategy and implementation to managed services. Find out how our experts can transform your insurance company.