Salesforce launched Financial Services Cloud (FSC) in March of 2016, and since that day, they have continued to introduce new features and improvements with each release. The Spring ‘21 release is no exception and comes packed with exciting new features.

Two of these features, Interaction Summaries and Branch Management, immediately add value for all FSC users and customers.

During my time working at a bank, I always got asked by different Relationship Managers, Retail Associates, Mortgage Lenders and other Salesforce users, “If I go to a meeting with a group, why do ALL of us that attend need to log the call or log the meeting for it to show on my goal dashboard? This just doesn’t make sense.” They would also ask, “This client is a Board Member, I don’t want everyone to see the details of the call, can we hide the details?”

Interaction Summaries

Bringing these requirements to reality used to be VERY difficult, however, with interaction summaries it is extremely easy to set this up.

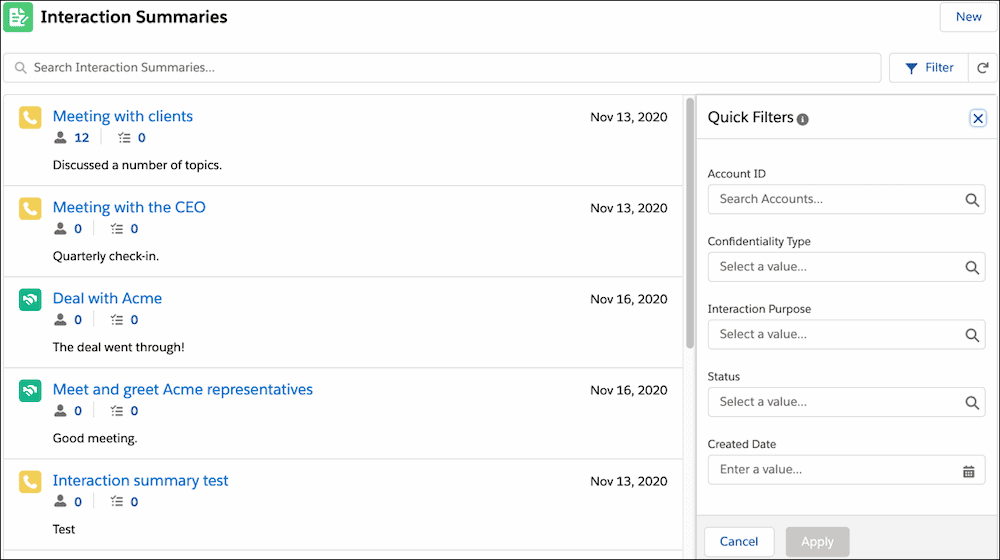

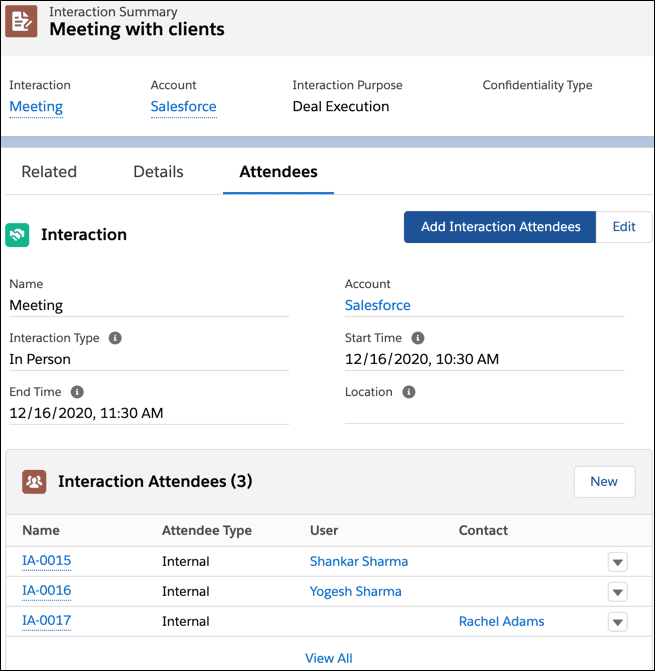

Interaction summaries give users the ability to reference a complete client history. All of the interaction history can be seen in one place, alongside action items or next steps to take after the interaction. Users can add all attendees to one interaction summary, add tasks to the summary and, most importantly, control the visibility of each interaction summary.

Was it a private banking client, board member, employee account or any other private interaction? No problem. You can set the confidentiality and limit who can see the interaction.

If you are currently using “Log a Call” and “Log a Meeting” to record your interactions with clients, you will need a plan to move off of this and onto Interaction Summaries. If you currently have reports and dashboards built around tasks, keep in mind that this will involve new report structures.

Branch Management

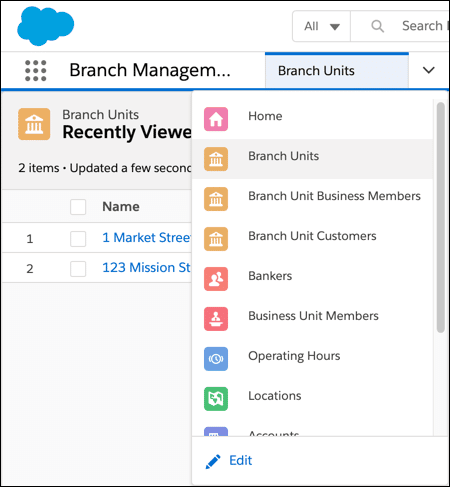

Branch Management is another feature available with the Spring ‘21 release for Financial Services Cloud. If your organization has struggled to align users and customers to the proper branch? When you create accounts and opportunities, do you want to track performance relevant to each branch?

This is where Branch Management from Financial Services Cloud can have an immediate impact for you.

Branch Association

The Branch Management data model combined with the Branch Association engine will allow banks to track the output of branches, employees, and customer segments. You can create reports around each branch and monitor performance around leads, accounts, and members of each branch.

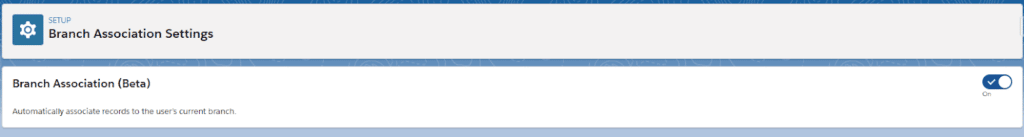

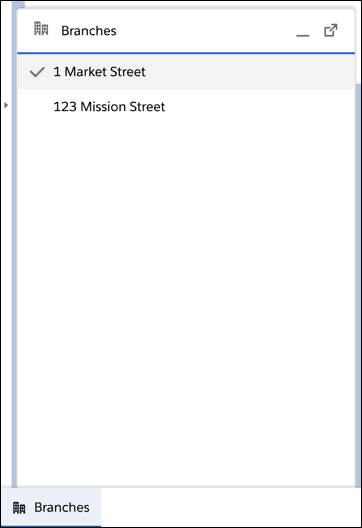

With Branch Management, you can define a Branch Hierarchy model, much like Salesforce’s role hierarchy, and assign the appropriate employees and customers to each branch to account for performance. Your Salesforce users can also select their branch and as long as you have enabled Branch Association, records will automatically be associated to the user’s current branch.

This is all available with Spring ‘21 and Salesforce will only continue to build onto this feature with coming releases to Financial Services Cloud.

We’re here to help you navigate all of the features within FSC and build a foundation for long-term success and business transformation.