Have you been to a Walmart lately? It is estimated that 90% of America shops at Walmart. There are approximately 150 million weekly visitors to Walmart stores and its digital properties.

That’s just bananas! Literally. The retailer sells more than 75 million products, and bananas are Walmart’s top-selling products.

Walmart is a prime example of a retailer with scale and customers with purchasing power. It is taking advantage of its vast retail ecosystem and customer base with Walmart Connect.

Walmart Connect is Walmart’s retail media network. Think of it as a publisher or media company that offers brands the opportunity to promote their products directly to its customers.

Walmart Connect helps brands target their customers in several ways. There is search and display advertising on its digital properties, including Walmart.com and the Walmart App. It offers media activations on in-store TV walls and self-checkout screens with nearly 170,000 digital screens across 4,500+ stores. Brand messages can be delivered with date, time, and geographic specificity.

Walmart is clearly doing something right. Its recent earnings report broke out advertising revenue for the first time, and Walmart cleared $2.1 billion worldwide.

Retail media overall is a $20 billion industry today, and that figure is expected to more than double, to $50 billion, in the next five years. This increase may be because retail offers a unique value proposition in the advertising landscape with the ability to influence consumers when they are close to making buying decisions.

What is retail media?

You may have heard a collective cheer from Costco fans around the country last spring. Free food samples were coming back! The shopping perk had been gone since the start of the pandemic.

The food samples are synonymous with the Costco retail experience. Brands featured as part of sampling benefit, and a pre-pandemic study about Costco’s samples found they’ve boosted sales by as much as 2,000% in some cases.

Free samples are just one segment of retail media. Retail media involves marketing to consumers when they are at or near their point of purchase, whether that be in-store or online.

In the pre-Internet days, retail media existed solely at brick-and-mortar locations. Newspaper circulars featured the latest sales. Store coupons were cut out with scissors. A five-foot-tall Santa holding a bottle of Coca-Cola stood next to the refrigerator case.

With advances in technology, digital advertising screens began to pop up on the shelves and at checkout. Store background music was interrupted by commercials targeted by the time of day or location.

Retailers started to monetize their online advertising space to target consumers outside the store. Digital ads appeared as “sponsored listings.” A grocery store site features a recipe for a chocolate cake with a brand of flour called out in the ingredients.

Retail Mcommerce, or mobile commerce, is rising, with sales hitting $359.32 billion in 2021, an increase of 15.2% over 2020. Mcommerce involves shopping through a mobile device versus eCommerce done through a computer. This type of retail media targets consumers with ads as they search for products on their phones or receive a text from a retailer with a digital coupon to drive them in-store.

What about retail media networks?

These days, the term retail media is most closely associated with forms of digital media. Brands are buying retailers’ digital advertising space, and this pivot to digital has led to the arrival of retail media networks, like Walmart Connect.

A retail media network is an advertising platform. Retailers such as Target or CVS deliver advertising opportunities to brands across their website, app, social media, etc. Think of it as bringing in-store advertising to a digital format.

A retailer can offer brands exclusive access to their customers through their network. Customer data is gathered from across the buyer’s journey, such as search and purchasing activity. This shopper data is leveraged to identify customer demographics, buying patterns, or other engagement metrics that would be of value to an advertiser.

In 2021, a quarter of retailers reported receiving more than $100 million in revenue from their media networks. The Evolution of Retail Media Networks study conducted by Merkle in 2021 found that:

- 81% of consumer packaged goods (CPGs) plan to spend more media dollars with retail media networks in the next year

- 62% of CPGs want to work with retail media networks for access to their first-party data

- 58% of CPGs view a closer relationship with the retailer as the biggest benefit of retail media networks

How can retailers best evolve their retail media network?

As they build their media networks, retailers face many of the same challenges that a publisher does. The media planning process is often not streamlined and different teams are working on each of the retailer’s media types, resulting in data being siloed across the organization. This lack of system integration leads to numerous pain points, such as missed campaign deadlines or inaccurate advertising analytics.

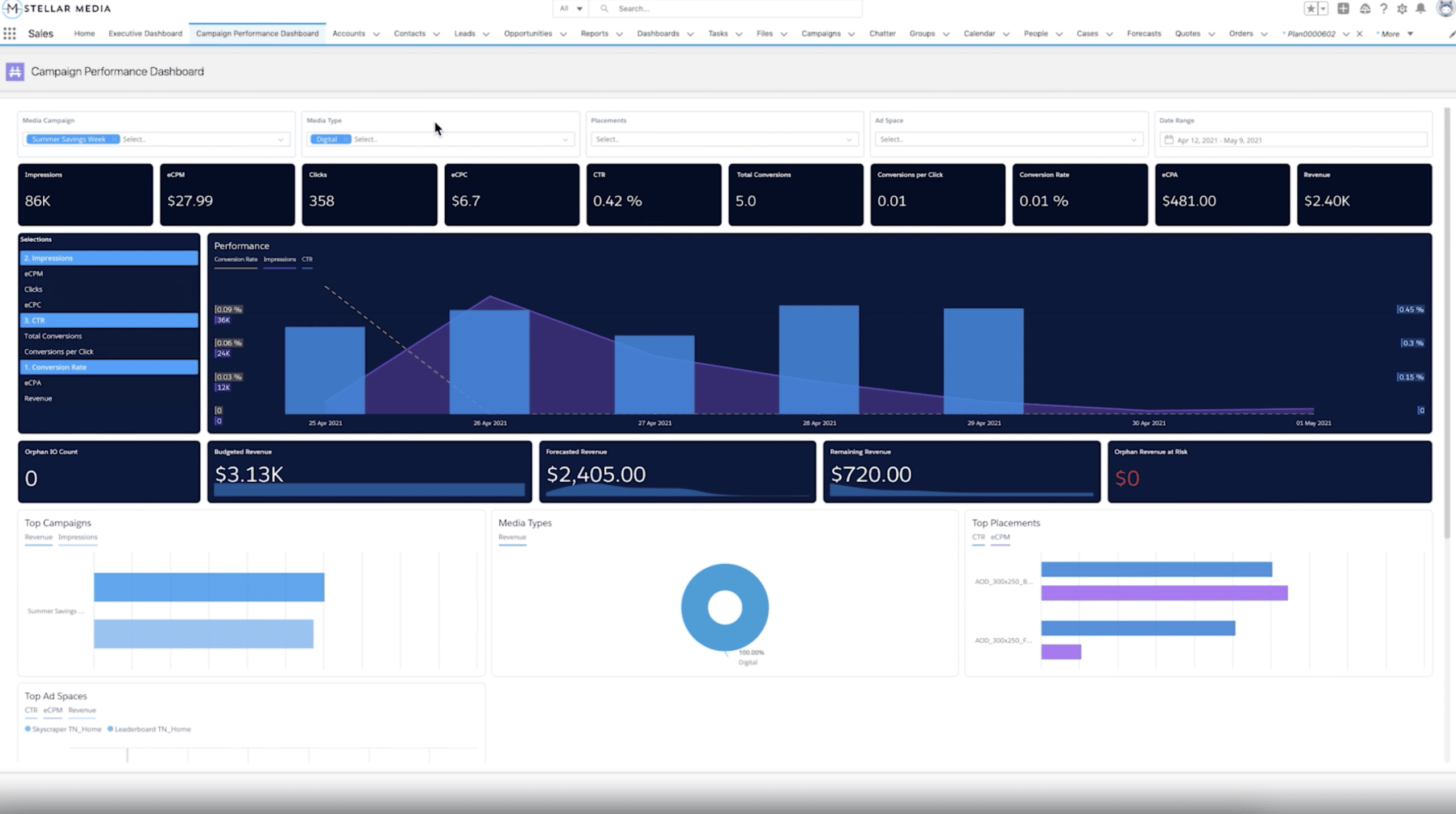

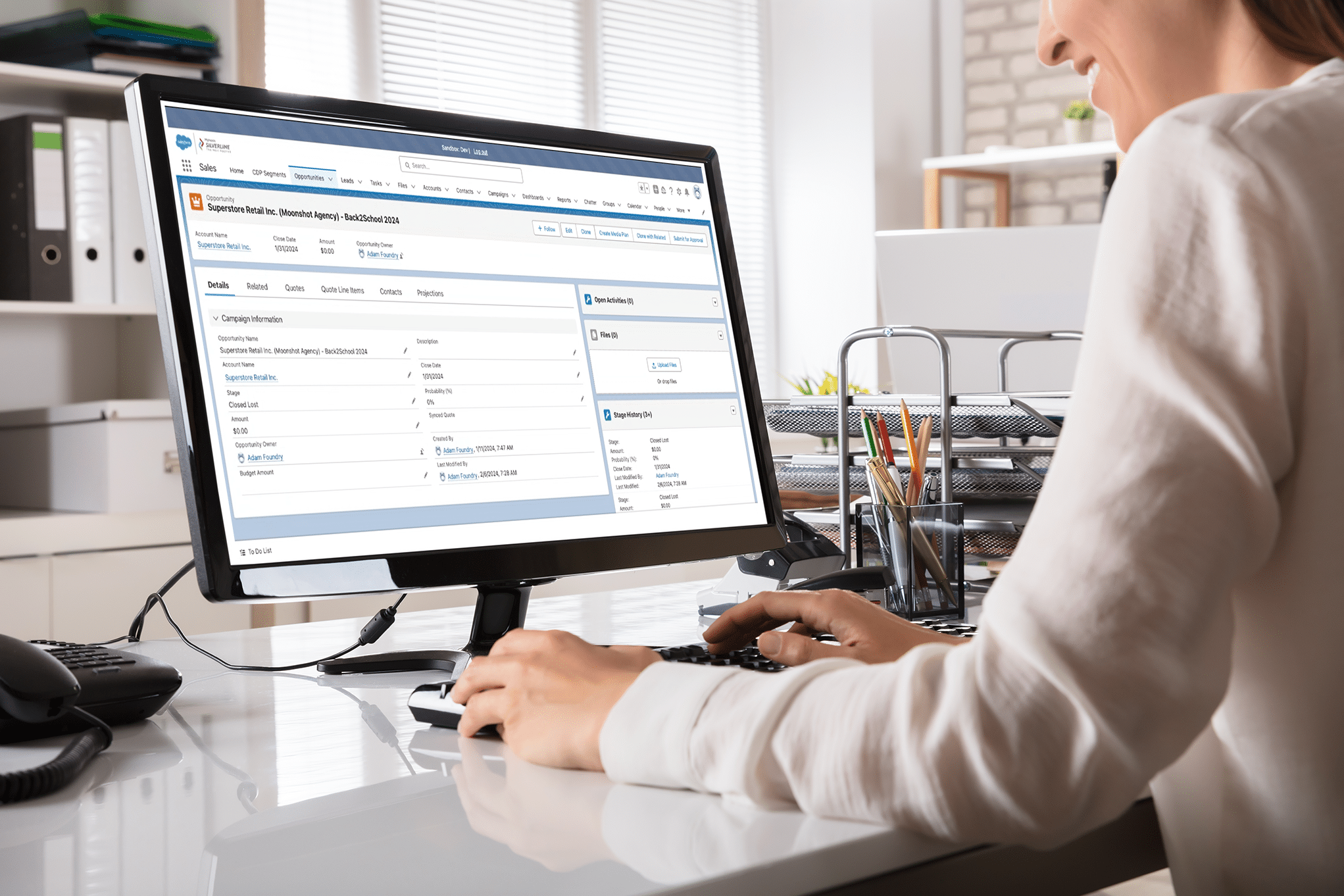

Retail media can curate a better journey for advertisers by using Salesforce Advertising Sales Management for Media Cloud. The system unifies multi-channel advertising offerings so that a brand’s journey might start with a digital promotion on the retailer’s website, transition to an in-store experience, and finish with an email newsletter. Media Cloud makes it seamless to conduct revenue scheduling, forecasting, campaign management, and other activities across the entire network.

Brands can segment specific customer audiences and select the campaign components relevant to them. With this heightened level of personalization, brands benefit from having access to a retailer’s first-party customer data to target consumers around their specific needs, which helps build engaging relationships with them.

Unlike other media, retail media offers advertisers the advantage of linking their advertising spending more closely with actual sales or other actions taken by consumers. Using Salesforce for retail media is especially beneficial because its analytics and dashboards provide visibility into timely insights, all in a single view, to optimize campaign performance.

How can Salesforce Media Cloud help with retail media?

Advertising Sales Management for Media Cloud is an industry-specific application for retailers to manage their advertising planning and execution. Retailers can easily operate their increasingly complex inventory and tracking from one integrated system.

At Silverline, we help retailer clients leverage Salesforce for their current and future advertising needs. Our team of experts has real-world expertise across advertising, media, and agencies and can guide you through every phase from strategy to implementation. Find out how we can help you grow your retail media network.