Wealth management requires high-touch white glove service to keep investors, their families, and their corporate interests in mind. As wealth management firms invest in technology-enabled solutions to help grow and scale their AUM, a great CRM tool should be at the top of their priority list.

Client relationships and operations are big topics, and can involve multiple teams and systems. For example, operations and client services team may be working on client day-to-day requests such as trading and cash allocation, quarterly statement setups and document requests, trust distributions, and more. Simultaneously, client relationship managers or sales team members may be working on growing the client’s existing portfolio of products and services through additional cash flow or change of strategy requests, portfolio reviews, and fee-based/subscription services.

When Silverline helps our clients tailor their Salesforce apps to accommodate these processes, our first recommendation is Service Cloud. Top wealth management firms leverage the powerful features of Case Management, a suite of Financial Services Cloud tools that help drive service excellence.

Streamlining the client request process

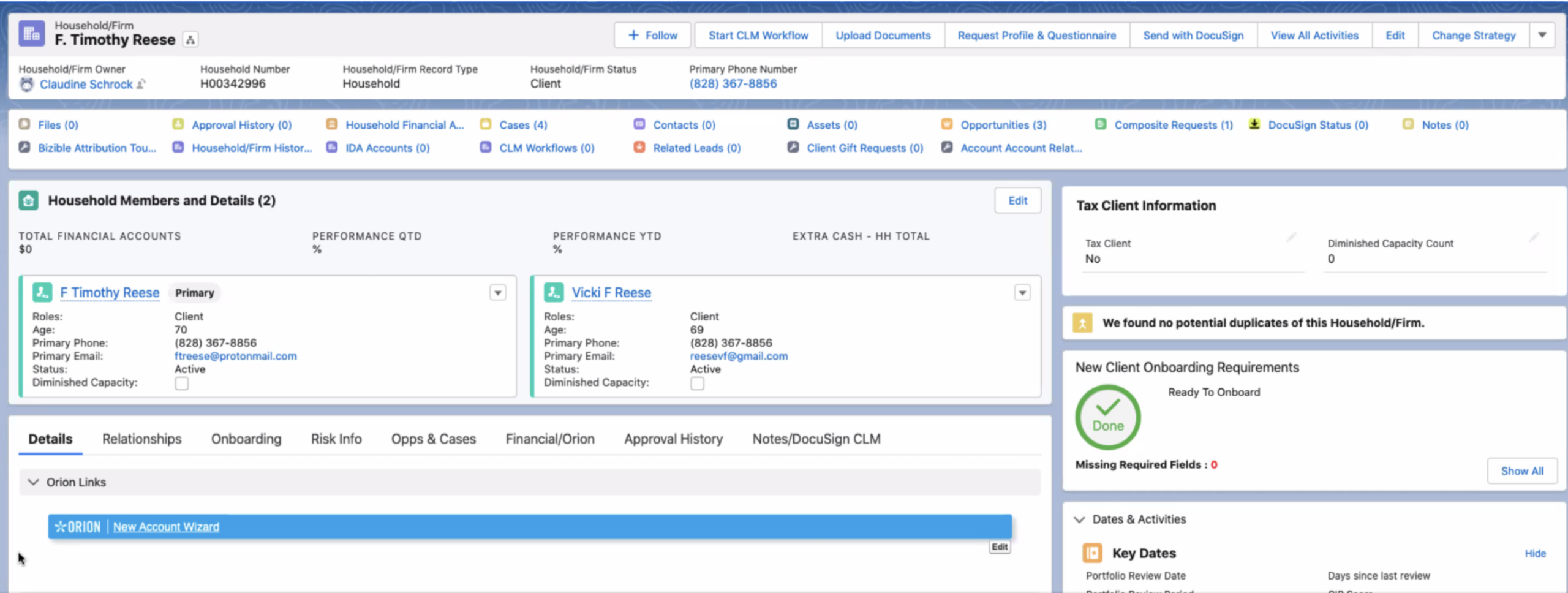

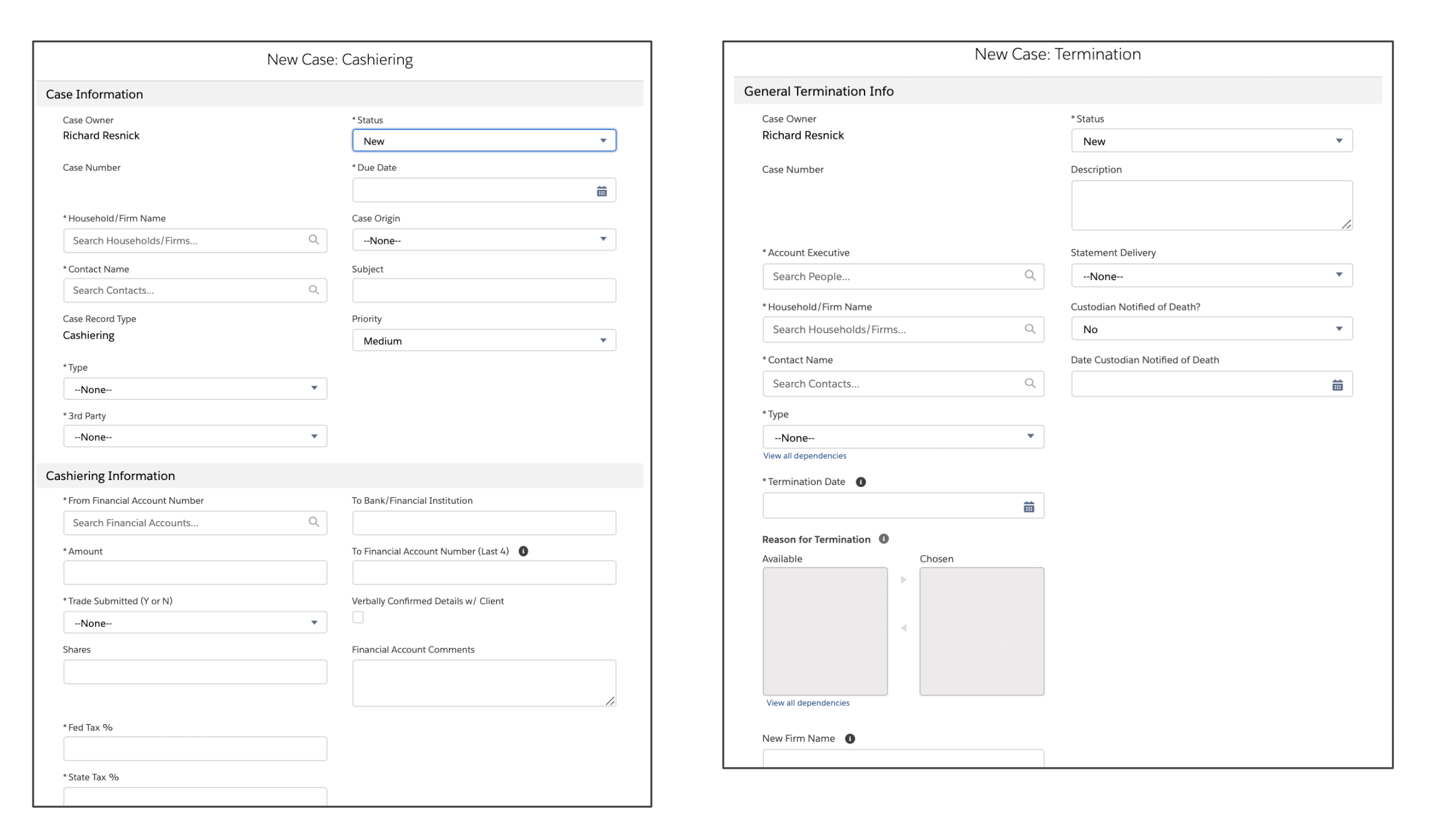

What does a day in the life of an advisor or middle-office RIA user look like? Typically, a client team member will begin the process of submitting an important client request from the client page in Salesforce, which eliminates redundant data entry since all client data is already captured, and then the user will select which type of service request they’d like to initiate.

Each type of service request can be customized to gather the appropriate detail for the request; distribution cases will look very different and require different details than cashiering, trade request, or termination cases.

Seamless integration with external systems

When it comes to back-office operations, most of these client service requests require that the actual transaction or financial account management is happening outside of Financial Services Cloud in systems like Orion, LPL ClientWorks, or Fidelity Wealthscape. To create a seamless experience for client service teams, Silverline helps users leverage the Salesforce AppExchange packages for each of these systems, which can be installed and deep-linked or windowed directly into Salesforce to create a single pane of glass.

In the example below, Orion is integrated so seamlessly into Salesforce and accessed through simple quick actions that it looks like a client service team member is completing the transaction in Salesforce, but it is actually happening in Orion. The client service request is memorialized as a case in Salesforce, available from the client page for reference, and the operations user can see all the submitted information to take action directly from the case screen.

Make more informed recommendations to clients

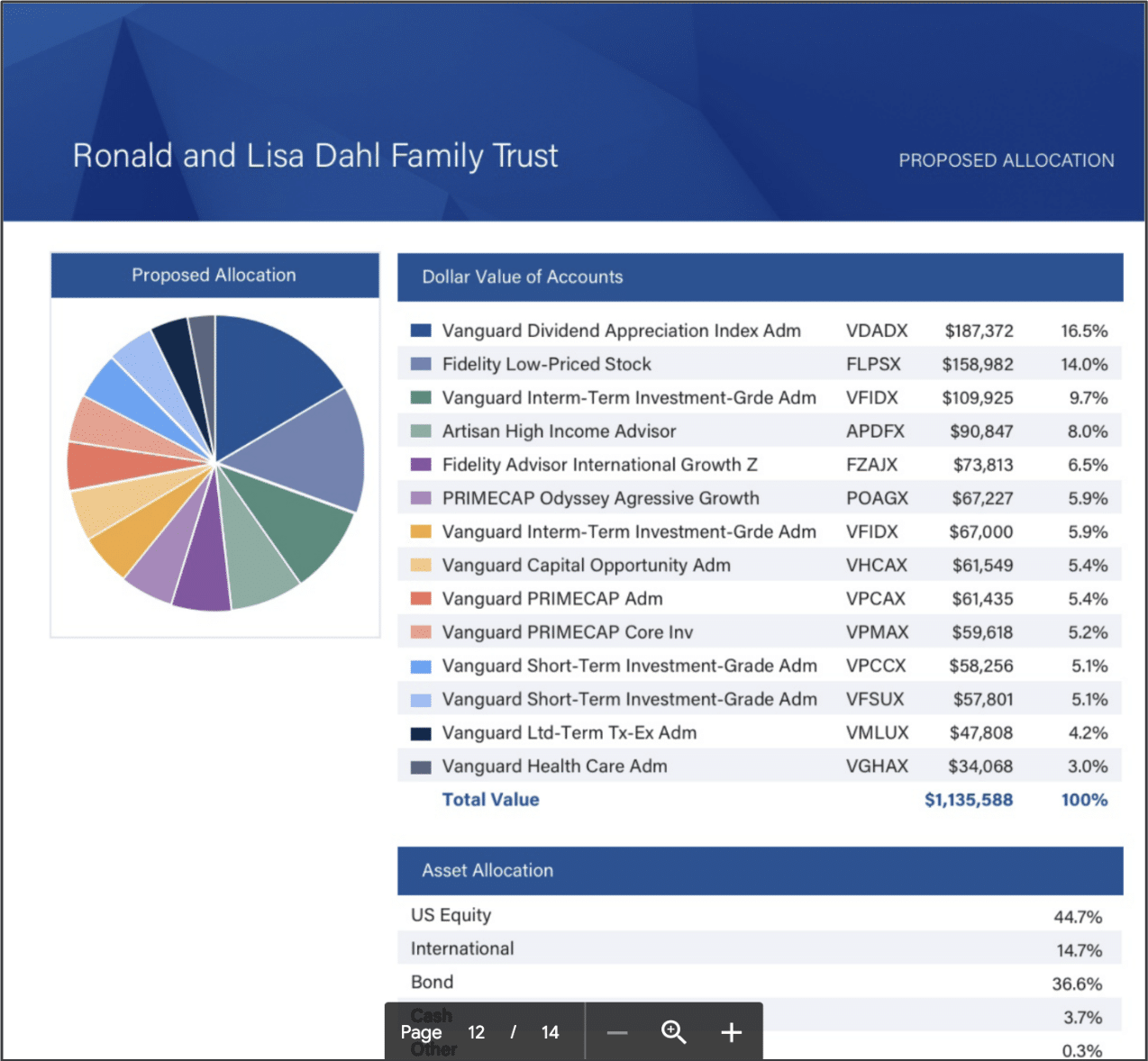

Other examples of common service cases for wealth clients are renewals, changes of strategy, and additional cash flows. Each of these types of requests can also be managed via Financial Services Cloud, and we commonly extend case functionality to accommodate for proposal management, which can save sales teams extraordinary amounts of time doing detailed presentations.

In these servicing requests, the relationship manager or client management team can intake the current holdings for a client, see information integrated from other financial planning systems, select a model portfolio, and adjust the new allocation to fit what they are recommending to the client – and then generate a PDF or presentation of the proposed adjustments.

By enabling one of the most time-consuming client servicing requests with smart Financial Services Cloud technology, the time to generate custom proposals can be drastically reduced. And once these proposals are generated, they can be sent to and reviewed by clients, placed on a client portal with smart notifications, or delivered via other common apps like Seismic.

One of the common considerations we hear from wealth management firms is that while there are systems like Morningstar that have tools to do planning and modeling, they don’t have nice visuals that can be client-facing. By bringing these service requests into Salesforce and leveraging powerful DPA and doc gen tools, advisor teams can save a lot of time on proposal generation.

Leverage your data to monitor client health

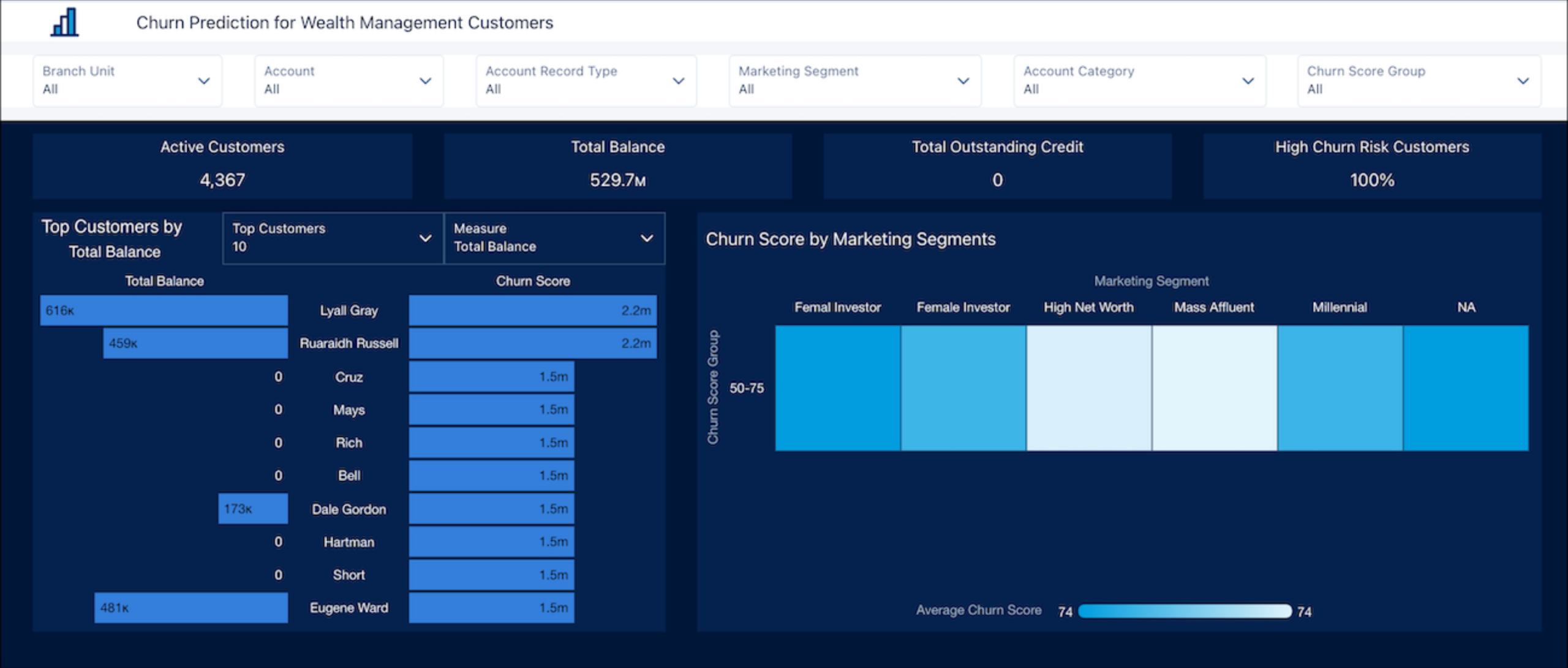

Last but not least, there are many powerful client service management features of Financial Services Cloud that can help executives report and analyze on data to benchmark their operational metrics. Reports, dashboards, and BI tools like CRM Analytics provide powerful insights when paired with the following service-centric features:

- Email-to-case and omnichannel support

- Tiered client entitlements

- Service-level agreements and escalations

Out of the box with Financial Services Cloud, advisors can use all of this client servicing data not only to ensure white glove service but to also begin predicting risk; in the churn prediction dashboard below (which comes out of the box with CRM Analytics for Financial Services Cloud), you can see an example of how top wealth firms can monitor client health and take action on the predictions if a client is at risk of termination, or evaluate who are your strongest and most loyal brand ambassadors.

Elevate your client services with Salesforce and Silverline

The time it takes to fulfill client service requests can have a significant impact on client satisfaction, and there are tools that can accelerate these processes in various ways. Silverline’s team of wealth management experts tailors digital transformation solutions to meet your needs with the foundational tools your advisors need to stay connected with clients, nurture relationships, and get robust insights from data.

Using the power of Salesforce Service Cloud, our team helps you deepen client relationships and retain their loyalty by ensuring that all of their requests are responded to and resolved. Find out how we can help your organization.