According to the Salesforce Connected Financial Services Report, over a third of customers switched their wealth managers in the last year, with the top reason for switching being a desire for a better digital experience. Wealth management customers want to be able to access routine investment management services (61%) and conduct tax (57%) and financial planning (57%) mostly or completely digitally.

But many wealth management organizations are still using paper-based questionnaires for prospects. The questionnaires lack the seamless digital experience that prospects expect and can make a company be seen as outdated.

Here we share how companies can automate their wealth management questionnaire to create a seamless digital experience that aligns with the expectations of today’s tech-savvy targets and turns them from prospects into customers.

Why paper-based questionnaires cause issues

As a wealth advisory practice grows and acquires more clients, the volume of paper questionnaires can quickly become overwhelming, resource-intensive, and heavily manual.

Using paper-based systems for wealth management prospect questionnaires can be slow and inefficient. Tasks like writing down information, finding data, and sharing details take a lot of time and effort and can lead to delays in making decisions and completing tasks. Additionally, because people have to write things by hand, there’s a higher chance of making mistakes, which can result in inaccurate financial profiles and recommendations.

Paper-based questionnaires often pose challenges for prospects due to their limited functionality. These traditional forms lack the capability to incorporate features such as conditional fields, images, or guided paths. Consequently, this absence of advanced features can lead to a less user-friendly and more cumbersome experience for individuals completing these questionnaires.

5 benefits of shifting to digital questionnaires

Switching from a paper-based approach to digital questionnaires at a wealth management firm can enhance operational efficiency and provide valuable insights for more effective prospecting. These insights are delivered promptly to wealth management advisors, aiding in lead conversion.

By using Salesforce, wealth management teams can utilize a custom portal and OmniStudio to create user-friendly and dynamic forms for prospects to complete, instantly updating their profiles in Salesforce. Here are the key benefits of transitioning to digital questionnaires:

1. Ease lengthiness

Initial questionnaires can be lengthy and make users feel overwhelmed by the many fields they need to fill in, not all of which may be necessary. Using Salesforce to create a digital questionnaire, you can set up conditions to keep your forms neat and straightforward.

For instance, if a user chooses “employed” as their employment status, the fields for collecting employment information will show up. These fields won’t be displayed if the user picks “not employed” as their employment status.

2. Reduce incomplete information

Using digital forms allows you to incorporate images and animations to create a straightforward and guided user experience. The added benefit is that it helps reduce errors and incomplete information from users.

3. Increase convenience

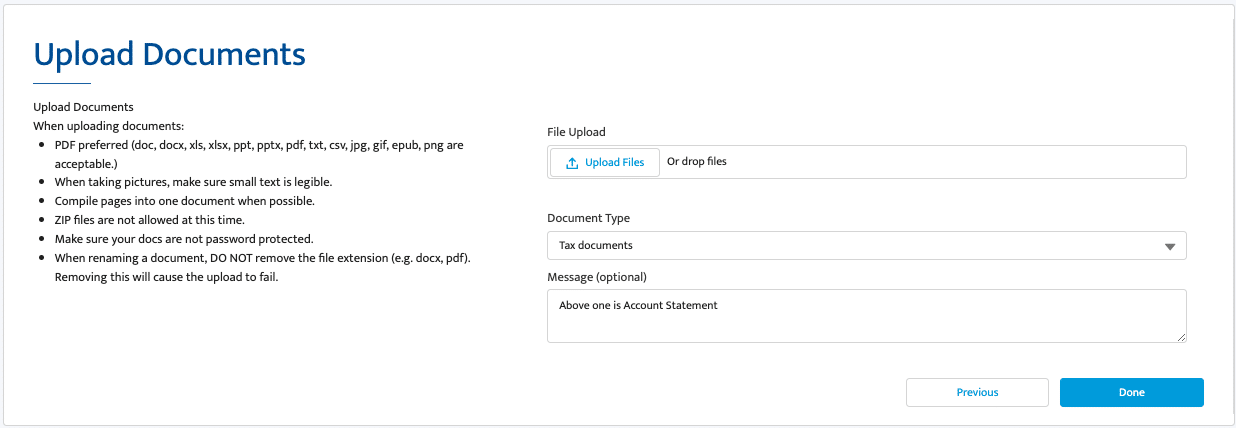

Wealth management teams can configure forms to allow users to upload files while submitting the form. This approach makes it a convenient and secure method for gathering the required data.

4. Enhance outcomes

Teams can promptly store the information in the prospect’s profile within Salesforce, which lessens the workload of manually entering questionnaire responses. This helps prevent data loss or delays, and the quick access to prospect data greatly enhances the outcomes of the prospecting process.

5. Exceed expectations

Last but not least, a digital experience that can be accessed on mobile and desktop is what the new generation of prospects and customers expect. Younger generations have grown up with technology. They have high expectations for the digital experiences businesses provide and want a modern and technologically advanced approach in all aspects of their interactions, including filling out forms or questionnaires.