As we all adjust to a digital-first, work-from-anywhere environment, how can we help teams better collaborate and stay connected?

We’ve helped countless leaders get started with their Salesforce journey, and we know firsthand that it can be a lot! That’s why we’re here to help.

Gaining a 360-degree view of customers or members is a top priority for just about every client and prospect we engage with here at Silverline. They are looking for ways to get customer information more quickly, and receive real-time insights so that they can bring more value to every conversation and drive operational efficiency across the organization.

With Salesforce OmniStudio (formerly DPA), teams can provide that top level of service and leverage the best digital tools available to consolidate systems and other operational efficiency drivers. I recently sat down with Salesforce Industries’ Vice President, Terry Sheehan, and Principal Solutions Engineer, Matt Wexler, to discuss the benefits of OmniStudio in the financial services industry. You can watch a recording of our conversation here, or read on for highlights from our conversation.

Overcoming the obstacles preventing digital transformation

Well before the pandemic, Silverline was helping financial services organizations digitally transform their business. Financial services firms around the world are reassessing the traditional ways of engaging with customers to drive a better experience for both customers and employees.

But it’s not always easy. Legacy challenges persist in retail banking, and organizations need to overcome outdated systems, manual processes, and fragmented data. These are some of the main obstacles we hear from our customers that make it hard for them to move to a digital experience and accelerate the shift toward straight-through processing:

- Siloed front, middle, back office systems creating disconnected employee and customer experiences

- Legacy technology systems resulting in slow and manual processes

- Long, manual text-heavy applications

- Manual underwriting, slow response to banker or customer submissions

- Offline or disparate payment and account issuance

- Inadequate portfolio insights

We’d be naive to expect that all of our customers and their customers would only want to operate from a digital perspective. Your customers have complex needs and there always will be a need for personal advice to help them through their life cycle and their requirements. In-person financial advice still has tremendous value, but not necessarily all advice needs to be in a human-to-human context. There are many areas where we are seeing more and more of a desire to go virtual and make it a digital experience, specifically in deposit account opening, loan origination, and onboarding.

Most of our customers see Salesforce as a CRM to gain a 360-degree view of customers, but the reality is they need more than that from the technology. It needs to go much deeper into banking core processes, from those mentioned above all the way through transactional servicing like dispute management and resolution.

That’s where OmniStudio comes in. An automation solution that has been widely deployed in other industries, OmniStudio was introduced to the banking industry this year, and it’s an exciting opportunity to help customers automate their processes by leveraging more modern tool sets.

How Salesforce OmniStudio modernizes operations and improves experiences

So what is OmniStudio? Let’s start with what it isn’t. It’s not a separate platform, cloud, or database. It’s a series of tools that reside within Financial Services Cloud, designed to enhance the delivery of Salesforce solutions. OmniStudio was created with these goals in mind:

- Rapidly deliver consumer-grade guided experiences across channels without code

- Initiate decisions or actions based on a collection of rules that consider inputs and outputs

- Orchestrate end-to-end workflows supporting straight-through processing or assisted interactions with automation

- Infuse customer data in context throughout the experience with no/low-code integration tools

- Create templates and generate highly formatted documents with Salesforce data

Focus on customer-centric automation with OmniStudio by simplifying the experience and the delivery of user-driven processes, whether they are executed internally in a call center, by a banker at a branch, or by the customer through a portal or mobile app.

Admins have the ability to declaratively deploy business rules to capture inputs, map to outputs, and come up with decisions on the fly, reducing the amount of exceptions or managerial asks.

Organizations can also orchestrate the end-to-end workflow across multiple departments and bring customer data into the customer workflow, whether that data resides in Salesforce or in third-party systems. And it’s all done with no/low-code integration tools.

Building better processes with OmniStudio tools

A powerful suite of low-code, task-based components, OmniStudio empowers you to consolidate applications, speed new users to productivity, and reduce your overall cost-to-serve. Those components include:

- OmniScript to design and deploy user-driven workflow, guiding users through complex sales or service processes with seamless integration to enterprise applications and data

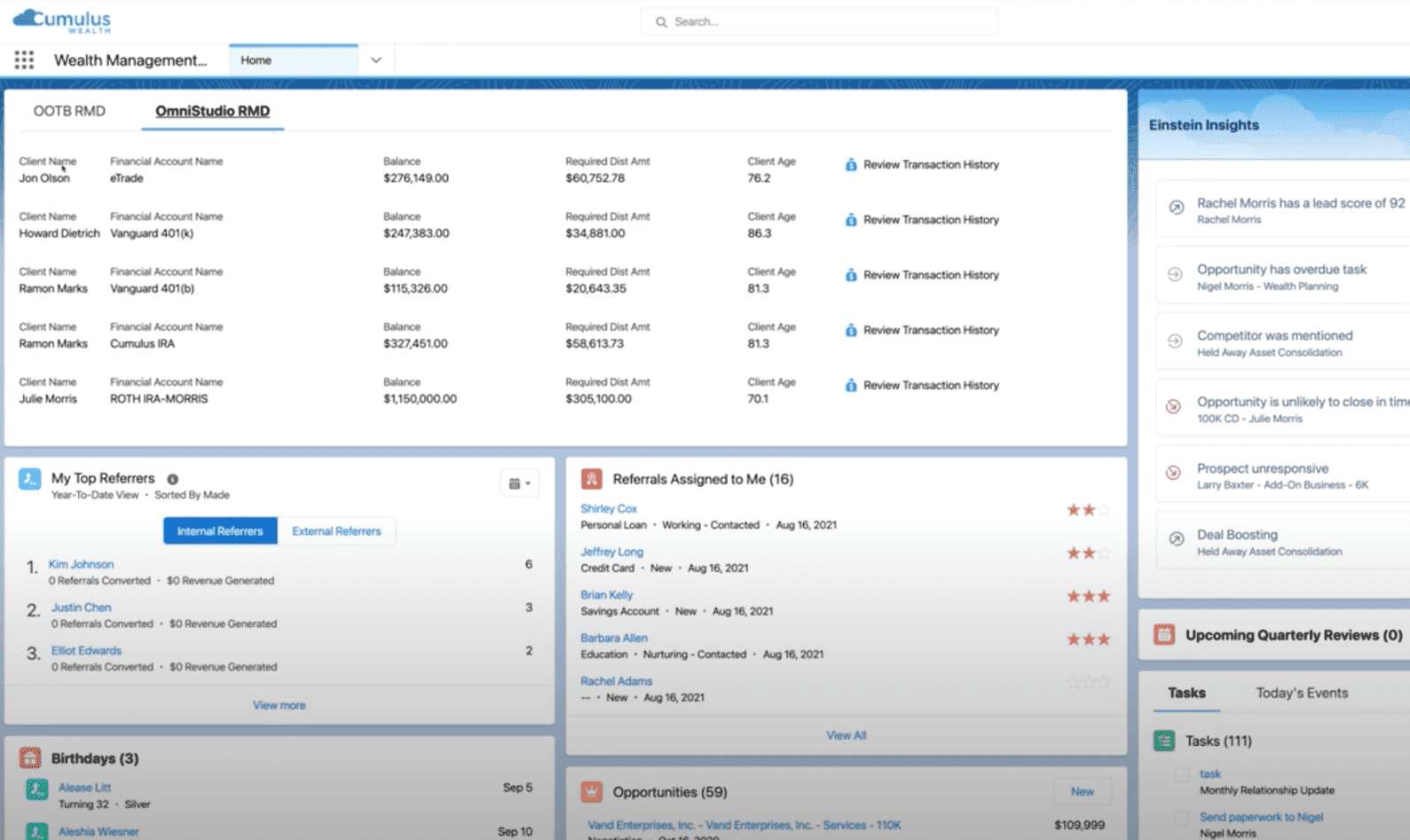

- FlexCards display contextual information in an at-a-glance format and provide access to relevant tasks for the displayed data

- Business rules exist in Calculator Matrix Procedures and Decision Tables, where users can do underwriting calculations, provisional credit calculations, and more, all declaratively without code

- Integration Procedures orchestrate integrations without code, calling REST APIs to external services and processing responses right into an OmniStudio AMI script or FlexCard

- DataRaptors work with complex queries and hierarchical data, pulling data into these experiences and pushing data into the Salesforce core database

A real differentiator for OmniStudio, compared to the way Salesforce has typically delivered UX with Lightning components, is that they wanted to deliver pixel-perfect styling. Previously, if an organization wanted their marketing department to control the final look and feel of their system, they needed to do a lot of custom work.

With OmniStudio, admins now have the ability to separate the logic and functionality from the design. Your marketing department can now provide the CSS file for the website, which allows you to be more agile with business processes.

All of these different components create an end-to-end solution for driving better user experience from an agent, banker, and customer perspective. From a guided workflow perspective, there’s less confusion around decisions that need to be made, more control, and fewer errors.

Watch Salesforce OmniStudio in action

At Silverline, we work with a number of banks, credit unions, and lenders of all shapes and sizes. Some of them are just getting started with their Salesforce journey, others have been down this road for a number of years.

We’re excited to bring the power of OmniStudio to financial services organizations, and our team of experts know the best practices to ensure a successful implementation. If you want to see a demonstration of OmniStudio, check out our webinar recording for a deep dive into all of the robust functionality. Contact us to learn how OmniStudio can help you respond to your unique business challenges.