With rising rates and declining origination volumes top of mind for many mortgage lenders, we could all use a magic bullet to make 2022 a successful year. It may not be magic, but utilizing technology with the data you already have can help you prioritize and allocate leads, identify cross-sell/upsell opportunities, and grow your portfolio.

Here we’ll share how to effectively harness information currently available to you to gain a single source of truth and a 360-degree view of your customers that helps to deepen relationships, personalize service, and increase wallet share. You’ll better understand how to leverage CRM Analytics to discover new opportunities in your mortgage portfolio with whitespace analysis and pinpoint the likelihood of converting leads so you know where to spend your time.

Mortgage trends brought about by economic conditions

It’s no surprise that the state of the mortgage industry is in significant upheaval. The market is continually shifting based on fluctuating economic conditions and the rate environment. These are some of the trends we are noticing with mortgages:

- Economic conditions: Rising interest rates are leading to a focus on value servicing.

- New revenue streams: There is continuing interest in cross-sell/up-sell opportunities as well as expanded product offerings, including non-qualified mortgages.

- Technology advancement: Mortgage as a service, AI, automation, and crypto are all taking center stage.

- Evolving customer expectations: Customers want end-to-end digital mortgages, and lenders need the technology, legislation, and mindsets to make it happen.

To dive further into the economic conditions for mortgage and lending, the interest rate environment, affordability, and market compression have seen dramatic changes this year. These statistics are from Q1 2022, and from what we’ve seen moving into Q2, the numbers will be even more staggering.

- 131 bps is the largest three-month change in mortgage rates since 1994. Thirty-year fixed mortgage rates rose from 3.11% to 4.42% in Q1 2022.

- -2.4% is the year-over-year change in existing home sales. New home sales are down 6.2% year-over-year.

- -1.4T is the estimated 2022 decrease in mortgage origination volume compared with last year’s high of around $4T.

So, what does all this mean for mortgage lenders? The primary-secondary spread of mortgage rates is signaling market compression, and the cost of originating purchase loans over a refinance is undoubtedly more expensive. Mortgage Servicing Rights (MSRs) are gaining value as rates rise and prepayment speeds decrease. That’s a plus for anyone who holds those and is looking to access the cash faster. There has been a considerable swing from refinancing to purchases, which are more complex, have higher production costs, and have longer turn times.

You probably see a lot of right-sizing in your organization from a staff perspective, leading to decreased origination volume due to a shortage of underwriters.

Solving the mortgage industry’s challenges with automation

Many of the mortgage industry’s challenges can be helped by harnessing the systems available at your fingertips. It starts with looking at your current processes and seeing if they lean more towards manual or automated. Much of the underwriting process is still very manual and should be streamlined to make it easier and reduce the amount of variation from file to file.

A more automated underwriting process also helps mortgage teams be less siloed and gives them greater visibility into what the other teams are doing. You want to ensure your servicing team is in sync with the same systems and messaging as the closing team, processors, and front-end salespeople. An automated process cuts down redundancy and increases efficiency among your teams.

Automating ensures a better experience for your customers and employees from beginning to end. These are three areas of opportunity to focus on:

- Product pivoting: Look at your customers and see where there are relevant whitespace opportunities to get them interested in a different product, such as homeowners insurance.

- Operational efficiency: Have better tracking of the approval process and the management of documents by keeping everything in the same place, so the entire team knows where to find what they need when they need it. Empower borrowers with a broker portal that makes the process easier with product and pricing engines.

- Customer satisfaction: Aggregate your data for hyper-personalization across multiple communication channels and make it all seem like one conversation from one company. For example, on a call, instead of a few stock sentences, inquire about the home values in the borrower’s neighborhood being on the rise.

New features of CRM Analytics for the mortgage industry

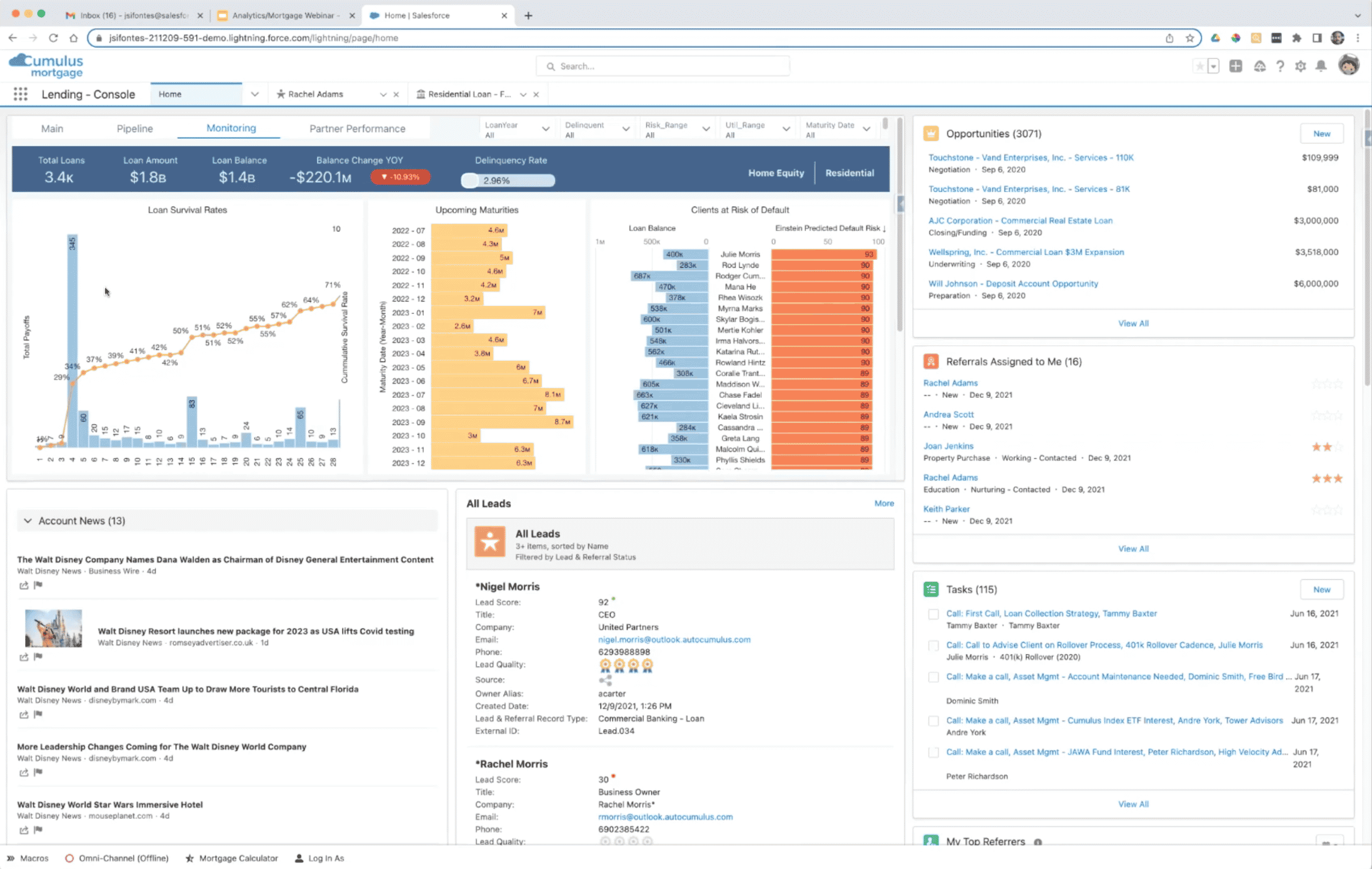

As part of the Salesforce summer 2022 release, Tableau CRM was renamed Salesforce CRM Analytics. CRM Analytics promises many new helpful features and dashboards that will be especially beneficial to the mortgage and lending industry. The latest release will help mortgage loan officers, branch bankers, and portfolio managers to prioritize their day-to-day work, grow their business, and seamlessly access, collaborate, and share insights. For example, using embedded and predictive insights to see if a customer already has a home loan and then suggesting that a home equity product might be a good fit for them.

Some of the relevant features of Salesforce CRM Analytics are:

- Einstein Discovery Text Clustering: Leverage machine learning to extract keywords from large text fields. Today’s mortgage institutions are resting on massive amounts of data, the majority of which is unstructured. The most common type of unstructured data is text, such as survey responses or emails.

- Ask Data for Salesforce: You can ask questions from the data using natural language querying and autocompleted suggestions to help you find insights quickly and easily. You’ll receive automated recommended next best insights and related dashboards matching your search.

- CRM Analytics app for Slack and Predictions in Slack: Bring data to every conversation and share insights and predictions to increase collaboration and decision-making, all within Slack workflows, to avoid swivel-chairing between systems.

- Data Manager: With new enhancements in Data Manager, you now get the additional features built around recipe sharing (folders), recipe chaining, and recipe visualization. You can view all the connections in the column list in the connection view and get clearer visibility of your data usage and limits from the new Usage view.

Grow your mortgage portfolio with Silverline

At Silverline, we have 260+ collective badges attributed to 40+ Salesforce Financial Services resources, more than 45 accelerators built for financial services use cases, and over 300 dedicated Financial Services professionals across advisory, technical, and implementation. We tailor digital transformation solutions for the mortgage and lending industry to meet your specific needs, accelerate your business process automation, drive operational efficiency, and increase customer satisfaction. Watch our webinar to see CRM Analytics in action.