Reading Time: 5 minutes

This is part three in a series on Connected Experiences for Banks and Credit Unions. Be sure to check out parts one and two,

All objectives ultimately roll up to keeping people happy by streamlining processes and simplifying technology to remove friction and roadblocks for all involved. Loyalty reduces costs by building trusting relationships with employees and customers alike. So it’s best to start out on the right foot.

Once you enroll a new customer, you want to make sure you keep them for the long haul. The amount of effort and time put into acquiring new accounts should never go to waste due to attrition. Acquiring a new customer costs, on average, five (5) times more than retaining an existing customer. Increasing customer retention rates by 5% increases profits by 25% to 95%, according to research done by Frederick Reichheld of Bain & Company.

That means, that now — more than ever before — customer loyalty is paramount.

But before a customer is loyal, you need to build up trust.

Identify quality leads and referrals

Managing your relationships should be an automated process that drives insights and pushes engagement versus requiring work to actually document and track.

A CRM helps your team be more dynamic with a marketing suite of tools that enables proper account nurture and provides cues for Next Best Actions based on collected information and common use cases.

From an engagement standpoint, once you start setting the right foundation for managing leads, customers, and opportunities, it’s all about creating the right programs to bridge the marketing automation with the physical interactions.

With the right expertise and human experiences added to the conversation, your team can engage and educate on new and needed solutions — especially important in a virtual world, where you’re not going to have as many in person interactions.

When we think about quality leads and referrals, we know that a tailored digital approach should be woven throughout our strategy to acquire and retain B2B customers in the banking industry.

How to retain B2B customers in the banking industry

When it comes to companies that interact with and serve other companies, there is a tangled web of relationships, priorities, needs, and partnerships. You want to make sure you’re targeting the right mix. Your business-to-business approach starts with the need to understand your business universe:

- What are my current clients’ main industries?

- Who do my current clients serve? Who are my clients’ clients?

- Where am I most successful with my current clients?

- What is the remaining universe of prospects that exist based on where I know I am going to be successful?

Once you understand your unified target audience, start to build a program around tracking against that universe and make sure you nurture and engage with it appropriately. Monitor the activities to drive lead conversion, which should ultimately drive to more pipeline and more happy clients.

With a well-defined program that helps make your leads and prospects look like your currently successful clients, you can start to apply personas to your client segments. A persona is a semi-fictional profile of your ideal customers. By sorting and categorizing your market research into your current client base, you’ll have a mock-up of what to look for in the clients you’d like to have.

Building out a program

Say you have a program around business banking. You define business banking as any business who has up to $10 million in revenue, with a potential credit exposure of up to $2 million. Once that is defined, you move on to determine which markets are your best bets. You know you have up to $10 million in sales to target. Say you also know when you have been successful in the past with manufacturing companies from a commercial and industrial lending standpoint.

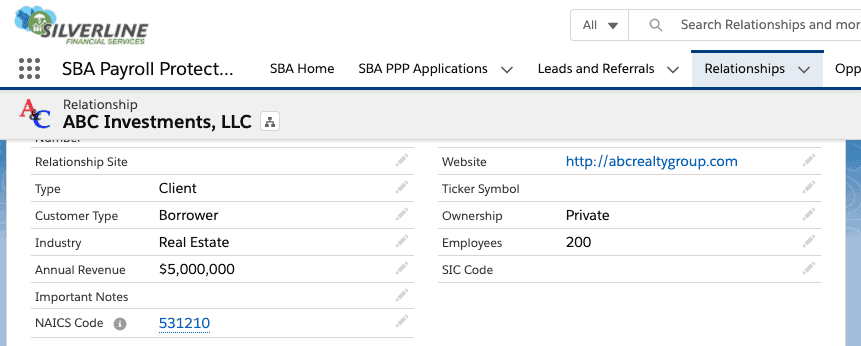

You decide to focus on how many businesses exist in specific markets aligned to your team that have sales between $1 million and $10 million, with an industry designation as manufacturing. As you research, you use a tool like Dun and Bradstreet or ZoomInfo. So you gather assets to understand the businesses, understand the attributes that you need to capture in the sales process and define your sales process around qualifying the lead based on the metrics. Metrics like:

Industry, number of employees

You can capture this information in Salesforce, as shown below.

Product mix

Check recent UCC filings to understand what they have and what institution they currently work with.

Business Facilities

Do they rent or own their facility being another data point? If they own it, you might be able to come in with a real estate loan to help them refinance based on rates, etc.

It’s really about understanding your successful clients, their product mix, and your expertise around how you serve those clients. Taking that knowledge and packaging it up into a well-defined sales process to capture the information is what makes prospects a successful client and removes friction from the conversion process from lead to opportunity in your pipeline.

Driving efficiency

By collecting all of the information and data points that determine lead quality, you drive efficiency not only for your team, but your potential clients. If a member of your sales team knows they have a hundred leads assigned to them, 10 of which already have 11 data points out of 15, then they’re probably much closer to being a quality lead.

When your leads and prospects look like your currently successful clients, the sales team is better equipped to identify the particular data points that they collect as they add something in the pipeline. From there, the data captured in Salesforce shows them that if they’ve been previously successful with these 50 clients and they know that these 100 prospects have very similar makeups, they have a higher likelihood of success. The team also becomes more engaged as they recognize the type of conversation they’ll need to have, the products they can position, and the type of person or the role to target to get in the door.

Rather than directly prospecting the CEO, or the CFO, they may identify the best entry point based on past successes (tracking COI referrals in CRM) is to go to their network of Centers of Influence (COIs) and get a warm introduction. And that’s how you not only acquire, but retain B2B customers in the banking industry.

Aligning sales and marketing

Traditionally, marketing teams and sales teams don’t get along. Marketers have a harder time getting buy-in from salespeople, who often feel like marketing campaigns distract from the conversations they need to be happening. Shared data between teams makes it easier to align efforts and maximize both teams’ capabilities. With Salesforce, marketing can track persona activities, product mixes, and business trends to help inform sales on what a client or prospect has going on. And sales has visibility into the research and real-time results, which gives them a better understanding of the why behind the marketing collateral they’re given.

Sales can stay focused on trying to prioritize the right leads at the right time — using marketing data to understand where to prioritize and why. And marketing uses that data to help support sales in other ways, such as by engaging leads through softer digital ads or inviting them to events based on sales making that first contact.

Or perhaps they build a nurture campaign designed to get prospects to reach out — tailoring the messaging to an industry’s specific pain points or struggles. Marketing can put in the pre-work to cut a couple of weeks off of a sales cycle, create a door to meet the right connection, and cut down prospecting meetings to one or two phone calls versus 20 or 30 phone calls. When the two teams work as one, acquiring and retaining B2B customers in the banking industry becomes that much more efficient.

Want to know more? Get a copy of our ebook.