Migrating to Financial Services Cloud

Take your data to new heights with Silverline and Salesforce.

Take your data to new heights with Silverline and Salesforce.

Salesforce has been the leading CRM solution for more than a decade. As a result, many financial services firms adopted Salesforce prior to the availability of Salesforce Financial Services Cloud (FSC). Frequently, these existing Salesforce Sales Cloud and Service Cloud customers wonder if upgrading to Financial Services Cloud makes sense for them.

As a top Salesforce partner with 10+ years of experience serving financial services firms across banking, lending, insurance, wealth, and asset management, we can help increase the return on your Salesforce investment by upgrading your existing instance of Sales Cloud or Service Cloud to FSC.

Financial Services Cloud is Salesforce designed for the specific needs of commercial & retail banks, wealth management firms, asset managers, and insurers.

Financial Services Cloud enhances and extends the functionality of Sales Cloud and Service Cloud to meet the needs of financial firms. FSC includes a data model that has been developed to enable financial institutions to deliver continuous innovation to their customers and employees.

Out of the box, Financial Services Cloud unlocks a wealth of new opportunities for your financial services organizations.

One of the first things that firms using Sales or Service cloud need to customize to support their business are objects for financial accounts.

Financial Services Cloud comes with a native Financial Account object with pre-defined record types for different types of financial accounts such as investment accounts, insurance policies, bank deposit, and loan accounts.

Client information in financial account data can be viewed for each member of a household as well as rolled-up to the member’s household record to give an aggregate view of a household’s holdings.

Financial Goals can be associated with an individual or a household and used to keep track of clients’ financial goals to build and document a strategy to meet those financial goals. As goals change, tracking goals in FSC with the capability to add & modify them gives your employees the ability to view how priorities evolve over the course of their client relationships.

Internal and external referrals are critical to the success of most financial services companies.

FSC includes native support for tracking referrals through the complete lifecycle, including tracking acceptance and conversion. Lead and referral records are also associated back to the source, letting your employees understand which employees, clients, or centers of influence are bringing the most (and best) leads & referrals.

Financial Services Cloud also offers intelligent need-based lead & referral scoring. This helps employees to focus efforts to nurture and convert the most promising leads. Leveraging Einstein Lead Scoring, new leads and referrals are scored by probability of to convert.

Financial Services Cloud action plans enable your employees to deliver consistent and compliant client engagement experiences by bringing workflow to the Salesforce platform.

With FSC Action Plans, you can define repeatable collections of tasks and then automate the assignment and tracking of the workflow. We have helped clients transform and automate critical business processes such as collecting and reviewing documents needed for loan origination, claim management, or new client onboarding.

Action plans allow you to not only track the required tasks in the proper order, but also standardize and automate document tracking and approval steps for these processes.

Introducing automation both reduces the risk of human error and frees your employees from the need to complete tedious manual tasks. This allows them to focus on attracting new customers and serving existing customers more effectively.

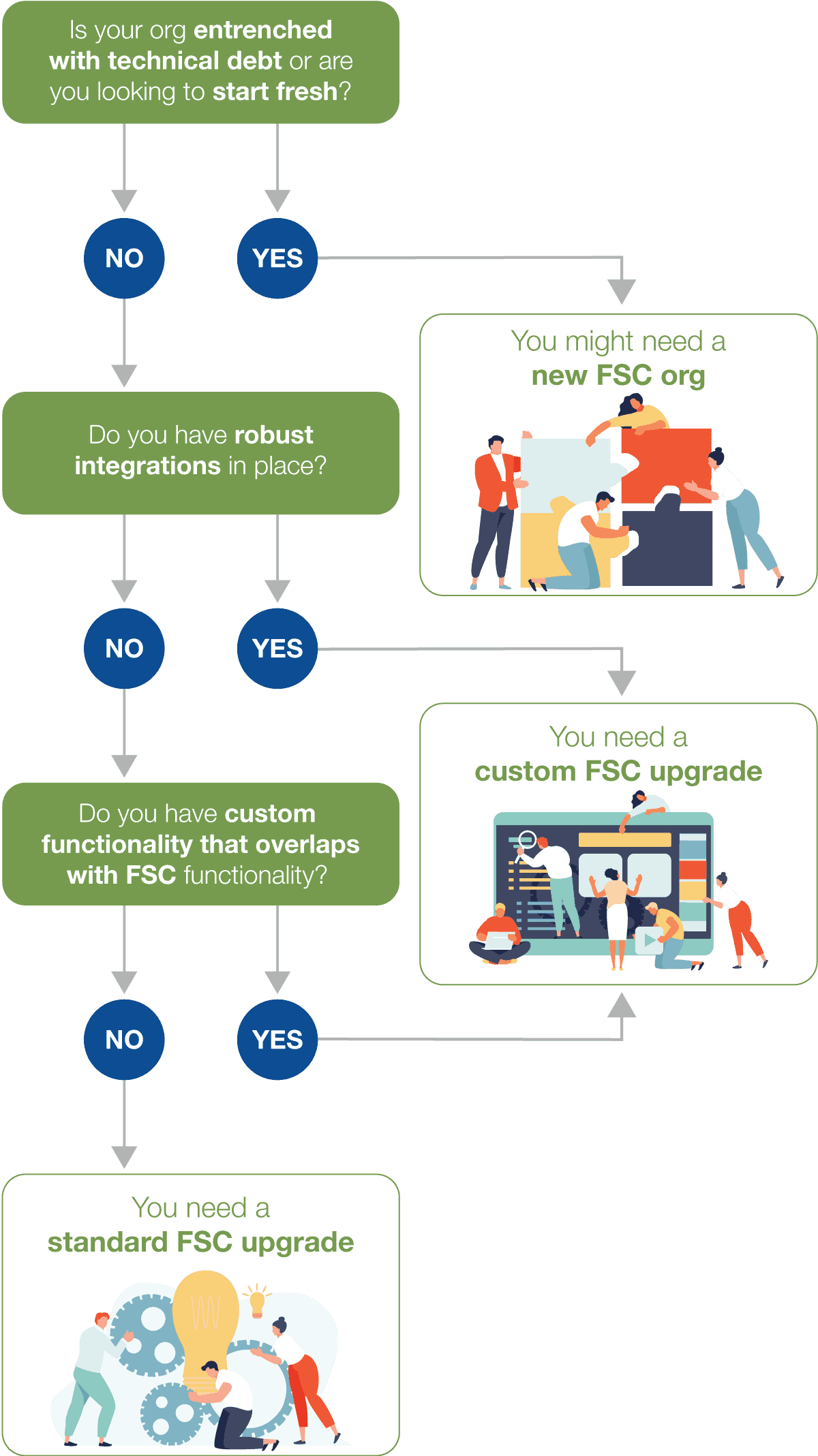

At Silverline, we have helped dozens of clients evaluate their current Sales Cloud or Service Cloud orgs to determine if migrating to Financial Services Cloud is right for them and if so how to proceed. A common misconception is that in order to take advantage of all the features and functionality FSC offers, an existing Sales or Service Cloud customer must re-implement their org from the ground up. Usually, that is not the case.

We’ve boiled down the upgrade options into three simple paths to success, depending on each company’s unique situation. Many existing Sales & Service Cloud instances don’t have extensive customizations or technical debt. In those cases, upgrading to FSC in the existing org frequently provides the fastest path with little to no disruption for existing users.

Walk through the infographic and let us know which path your organization fits into. If you cannot easily answer these questions or you are unsure, just reach out below! We’ll help to evaluate your current org to determine the best approach for your situation.