This is part four in a series that addresses the technology trends the Private Equity industry is facing. Curious to read more? Here are parts one, two, and three from the head of our Capital Markets practice.

As Private Equity firms look to optimize operations and plan for more effective integration strategies, at the heart of these efforts lies the value of a new currency firms are just beginning to unlock — that of the organization’s data.

“Less than half an organization’s structured data is actively used in making decisions — and less than 1% of its unstructured data is analyzed or used at all.”

– Leandro DalleMule and Thomas H. Davenport, Harvard Business Review

With the power of data on the minds of many, PE firms find themselves asking questions like:

- How do you extract the most valuable data from your operations and create insights on what decisions should follow?

- How do you best mine the data from within your portfolio?

- How do you augment data with market intel to surface new opportunities?

Chasing a moving target

At Silverline, we believe that a good data strategy is one that is always evolving. Above all else, it is important to get started, and to get practice. Organizations that see superior results from their data strategy have been at this for years and have already crossed the bridges of normalization, of cleansing, and of data governance.

But for firms that may have a lagging data strategy or want to toss out their old playbooks in this time of unprecedented change, we are helping our clients form data roadmaps and new action plans for moving forward.

Our industry and data engineering experts alike find great wisdom in a quintessential HBR article, “What’s Your Data Strategy?” published in 2017, as it provides a centralizing theory that grounds the tenets of data strategy. HBR argues that “less than half an organization’s structured data is actively used in making decisions – and less than 1% of its unstructured data is analyzed or used at all.” But how can we use the wisdom of this article to unlock more value from the data of the typical Private Equity portfolio?

Defense vs. Offense

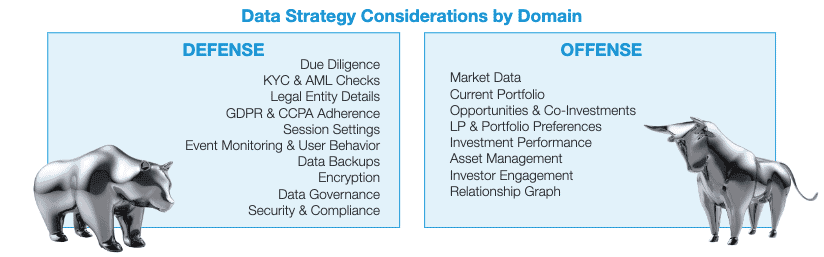

In “What’s Your Data Strategy?,” authors Leandro DalleMule and Thomas H. Davenport posit that there are two major functions of a well-balanced data strategy: data for defense, and data for offense.

A data strategy first considers its defensive posture, but what does that mean for the private equity firm?

In practice, this means that the technology applications we deliver are connected to or integrated with sources of data to manage downside risk, to comply with regulations, to prevent data theft, and to ensure appropriate cybersecurity. This is especially apropos as related to COVID-19, as all Private Equity firms have fundamentally shifted how and where they work.

Playing defense

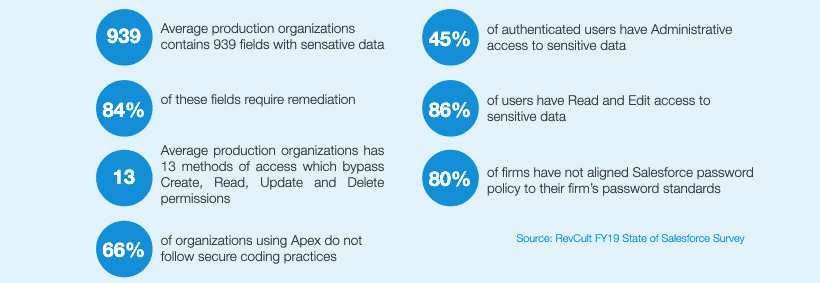

Fortunately, the robust security toolset of Salesforce Shield does much of the heavy lifting for our clients and creates a strong foundation for this defensive data posture. We recently did a webinar and interview with industry-leading Security and Compliance provider RevCult to share insights about how quickly security postures have changed in the last several months. Their insights have led to a strong working partnership with our Silverline Security Team to deliver joint security-focused workshops and help our mutual clients understand the fast-shifting landscape, outline go-forward options, and execute action plans quickly.

Firms looking to round out their data defense must also consider the processes by which they govern and steward their data so as to maximize decision-driving capability, and create shared standards for analytics and reporting. Many of the firms we work with have let go of a legacy of bespoke analytics to standardize the toolsets they provide to deal professionals and investment principals. Shared understanding of metrics and shared toolsets for data mining maximizes efficiency across a private equity firm; our own portfolio under Pamlico Capital reports on a foundation of Salesforce’s Einstein Analytics. We are helping many firms realize the fruits of similar strategies.

Strategic offense

Beyond defense, our private equity clients plan and execute data strategy offenses as well. These data plays focus on business objectives such as growth through sourcing new acquisitions and add-ons, assessing profitability through integration to fund and asset performance management systems, and driving investor/client engagement and satisfaction. Typical data offenses take into consideration real-time insights into the firm’s remaining dry powder, what capital is being committed and how related assets are performing, and seek to surface market signals that offer insights into investment decisions. When these types of offensive data strategies are underpinned by a modern API-led strategy, PE firms are well-positioned to reuse technical assets across their portfolio, future proof enterprise architecture, and unlock greater value by extending these APIs to power additional internal and client-facing applications.

“Business leadership isn’t aligned on the impact of integration.

In a recent survey of 650 IT leaders, 40% reported that APIs improved innovation and 53% said they improved productivity, both of which reduce mass inefficiencies across technology teams. Though the report found alignment between business and IT leadership is growing year over year, only 15% of organizations report having a leadership-mandated API-led strategy, suggesting the majority of organizations’ leaders have not yet bought into the value integration initiatives could bring to the organization.”

– How to Articulate the Value of Integration, MuleSoft, 2019

Common tactics we implement for Private Equity clients to support their data offense strategies include integration to market data providers like CapIQ, Preqin, Pitchbook, FactSet, and Reonomy; integration to fund reporting or asset management systems like FIS or Yardi; and integration to data lakes and master data management systems that provide for future expansion to core and niche data sources.

Many of our Private Equity firms are also leading the charge to adopt next generation reporting and analytics tools. Salesforce’s predictive Einstein Analytics suite, alongside their $15.7 billion acquisition of Tableau in 2019, opens new opportunities for evolving analytics. And new natural language processing capabilities through Salesforce Einstein Voice Assistant and analytics providers like Salesforce Ventures-backed Quarrio provide conversational analytics that quickly tap into big data to rapidly innovate reporting.

In the last several years, the market data landscape has dramatically expanded. Our goal is to help clients understand the landscape and educate about what options exist, navigate the build-vs-buy equation, and ultimately develop organizational proficiency in the data mining long game. It is our belief that there may be an immediate pull-back to strengthen defensive data strategies due to the impact of COVID-19, but the firms that can shift fastest to address their offensive data strategy will find competitive advantage.

Are you ready to build out new data roadmaps and design action plans for moving forward? Silverline can help. Get the full report to learn more about Private Equity trends for the future.